![The benefits of managed portfolios [PODCAST]](/content/dam/thrivent/fp/fp-insights/advisors-market360-podcast/advisors-market360-podcast-16x9-branding-insights-card.jpg/_jcr_content/renditions/cq5dam.web.1280.1280.jpeg)

The benefits of managed portfolios [PODCAST]

Why they may be a good idea for clients and an even better idea for financial advisors.

Why they may be a good idea for clients and an even better idea for financial advisors.

02/27/2026

FEBRUARY 2026 MARKET UPDATE

02/06/2026

Investors may want to consider rotating from cash to Treasuries and/or corporate bonds.

Thrivent Asset Management contributors to this report: John Groton, Jr., CFA, director of administration and materials & energy research; Matthew Finn, CFA, head of equity mutual funds; and Charles Hofstrom, CFA, investment product manager

Despite tariff uncertainty and a weaker U.S. dollar, economic data in January continued to show resilience.

Consumer confidence weakened, but retail sales and manufacturing activity improved.

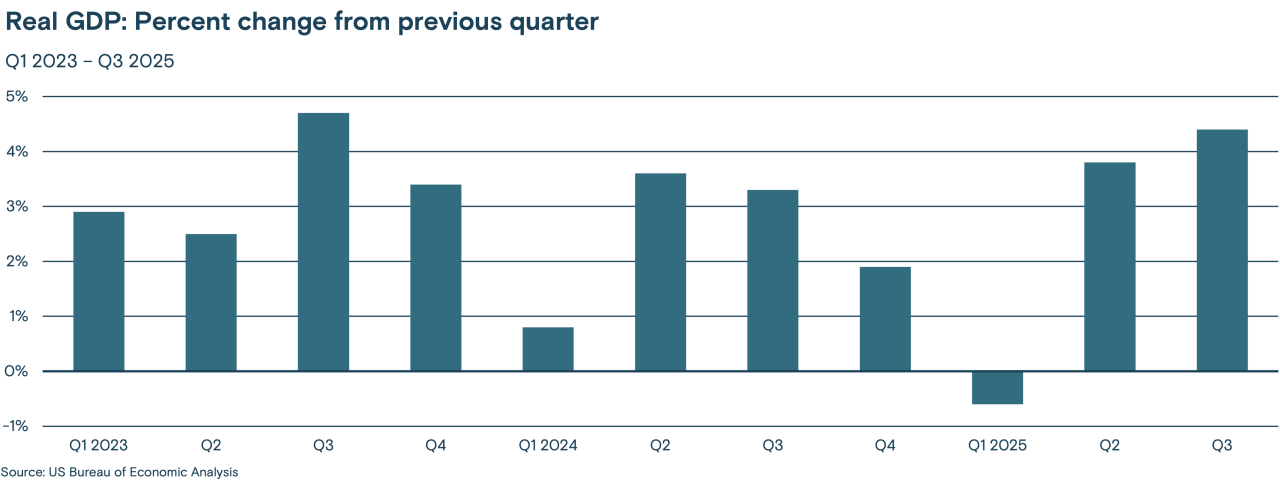

The economy: Economic data released in January was broadly supportive, indicating continued resilience amid renewed uncertainty around tariffs, a weaker U.S. dollar and rising geopolitical tensions. Consumer confidence continued to weaken, but retail sales in November were higher than expected, and manufacturing activity significantly improved during the month. The release of January’s employment data was postponed to February 11.

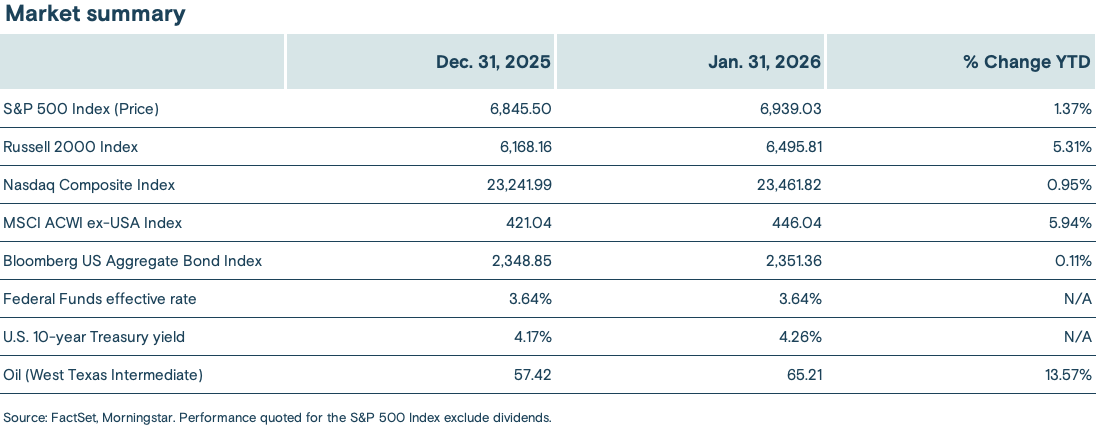

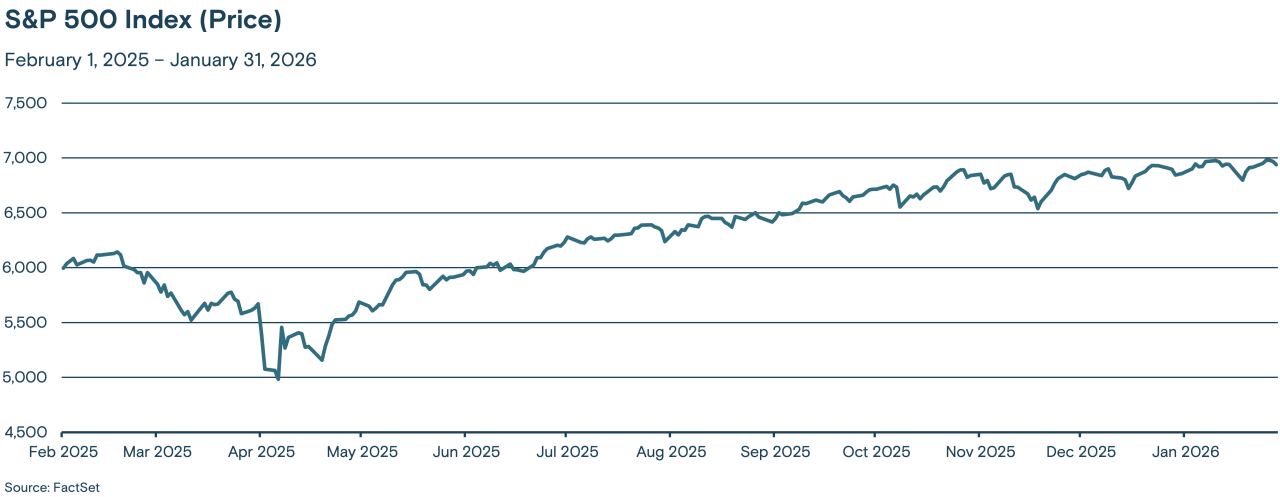

Stocks: The S&P 500® Index rose a relatively modest 1.37% in January (its ninth consecutive monthly gain), while the Russell 2000 Index of small-cap stocks rose 5.31%, suggesting investors were broadening their exposure away from large-cap technology stocks. The information technology sector was among the worst performing in the S&P 500 Index, while more defensive sectors, such as materials and consumer staples, outperformed the broader index. International equities outperformed their domestic counterparts in January, rising 5.94%, in part fueled by a weaker U.S. dollar.

Bonds: Benchmark 10-year Treasury yields rose in January, from 4.17% at the end of December to 4.26%, as the economic data released over the period broadly signaled continued strength, while concerns about inflation, a weaker U.S. dollar and U.S. fiscal policy lingered. As expected, the U.S. Federal Reserve (Fed) kept interest rates unchanged in January, while expectations for future rate cuts were pushed back. Investment-grade corporate bonds continued to tighten their yield spreads over comparable Treasuries. The Bloomberg U.S. Aggregate Bond Index rose 0.11% in January.

The economy: The low level of consumer confidence is a potential cause for concern, while the extent of weakness in the employment market remains unclear and a key concern. The rebound in manufacturing is encouraging, and we continue to expect the economy will find support from strong corporate earnings, a relatively low unemployment rate, lower interest rates, tax cuts, deregulation and an expansionary fiscal policy.

While the possibility of a recession persists, our base case remains that growth will moderate from its 2025 rate, but the economy will avoid a recession.

Stocks: We maintain a modest overweight position in equities over fixed income, given our structurally positive long-term outlook for the economy and our bias toward prioritizing economic fundamentals and corporate earnings as the primary determinants of investment returns over the long term. However, we will continue to monitor the expectations for large-cap technology companies to monetize their investment in artificial intelligence and deliver strong earnings growth.

Maintain exposure, favoring higher-quality and large-cap stocks but begin to broaden out into other areas of the market such as value, small-caps and international equities.

Bonds: As impact from tariffs on the inflation rate fades, we continue to expect lower interest rates in the quarters ahead. This suggests continuing to favor shorter-maturity Treasury securities, which are most sensitive to Fed rate cuts. In the corporate credit market, tight credit spreads lead us to favor higher-quality corporate bonds in the current environment.

Stay at the short end of the Treasury curve and favor higher-quality corporate bonds with less exposure to tariff uncertainty and macroeconomic weakness.

Economic data was broadly supportive in January, with the Institute for Supply Management (ISM) Manufacturing Purchasing Managers’ Index (PMI) rising to 52.6 in January from 47.9 in December, a gain well above expectations closer to 48.5. The ISM PMI is constructed to indicate that any reading below 50 signals contraction. Because the index had suggested the U.S. manufacturing sector was contracting throughout 2025, the rise above 50 in January could signal a rebound.

Consumer confidence fell sharply in January. The Conference Board reported that its index of consumer confidence fell to 84.5, below the lowest level reached during the COVID-19 pandemic. However, the final reading of the University of Michigan’s Consumer Sentiment Index reported in late January showed an across-the-board improvement in sentiment, rising from 52.9 in December to 56.4 in January. Additionally, retail sales rose more than expected in November, at 0.6%, a reversal from October’s 0.1% decline.

The Bureau of Labor’s January employment report was delayed until February 11 due to the recent government shutdown. A Dow Jones survey expects the report to show unemployment remaining steady near 4.4%, with a gain of 60,000 jobs in January, slightly higher than the 50,000 created in December. However, data released by the Bureau of Labor on February 5 showed the number of job openings fell to 6.54 million in December, near a five-year low, while hiring and layoffs remained steady.

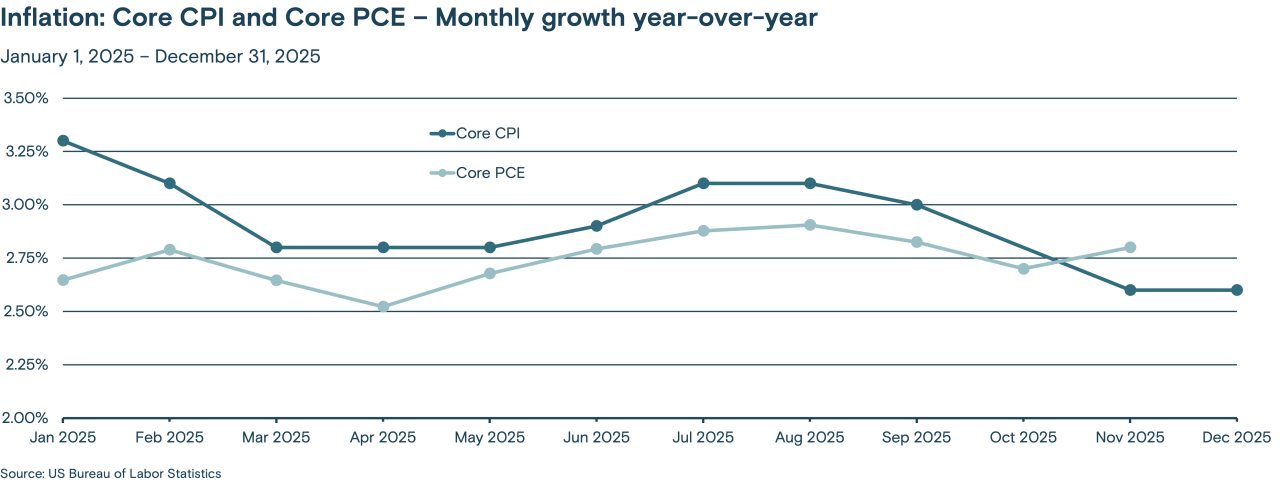

December’s Core Consumer Price Index (CPI) data rose less than expected, up 0.2% relative to November, and 2.6% relative to December of 2024. Data for October and November’s Personal Consumption Expenditures (PCE) Price Index data, the Fed’s preferred measure of inflation, was released on January 22, showing a year-on-year rise of 2.7% and 2.8%, respectively. While the figures are above the Fed’s target level for inflation, the month-on-month rises of 0.2% in both October and November suggest some stabilization in inflation.

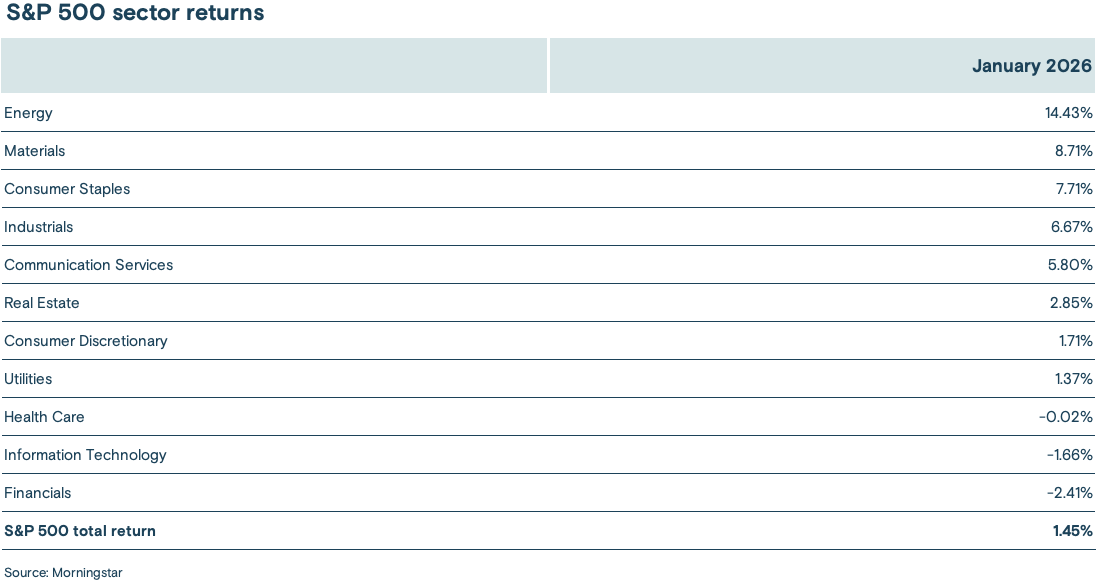

U.S. stocks saw broad-based strength in January. The benchmark S&P 500 Index of large-cap stocks rose 1.37%, while the Russell 2000 Index of small-cap stocks rose 5.31% and the Nasdaq Composite Index rose 0.85%. Encouraging results from fourth quarter earnings reports supported returns, while value stocks broadly outperformed growth stocks for the third consecutive month. The energy, materials and consumer staples sectors led the S&P 500 higher over the period, while the information technology sector fell (down 1.66%).

The table below shows the past month performance results of the 11 sectors:

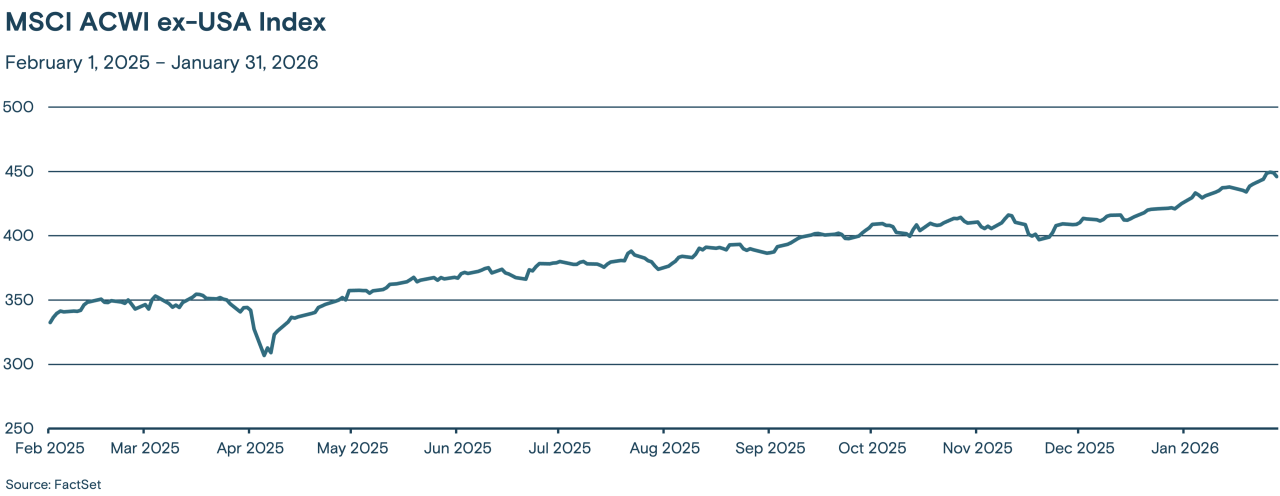

The MSCI ACWI ex-USA Index, which tracks stocks across developed and emerging-market economies across the world (excluding the U.S.), rose 5.94% in January, outperforming the S&P 500 Index. A weaker U.S. dollar was broadly supportive for international equities, while European equities were boosted by better-than-expected Eurozone gross domestic product (GDP) in the fourth quarter. Japan was the best performer among developed markets, rising approximately 5% over the month, while emerging markets generally outperformed developed markets, rising by around 9% over the month.

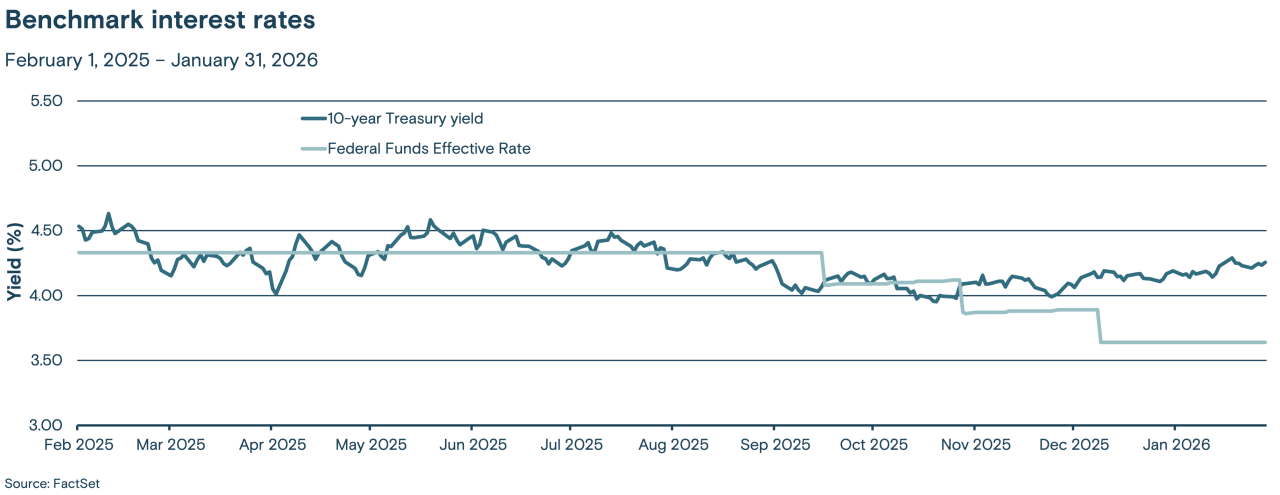

Benchmark 10-year Treasury yields climbed over the month to 4.26%, 0.09% above their yield at the end of December. Increased uncertainty about the investigation of Fed Chair Jerome Powell contributed to the rise early in January, while ongoing concerns about inflation and a weaker U.S. dollar continued to weigh on bond prices. As expected, the Fed kept interest rates unchanged at its January monetary policy meeting, and generally positive economic data led investors to lower their expectations for further near-term rate cuts.

Investment-grade corporate bond yield spreads (the amount of yield paid over comparable U.S. Treasuries) continued to tighten in January, supported by strong demand and robust fundamentals. High-yield bonds (those that carry a sub-investment-grade credit rating) saw their spreads decline over much of the month, only to rebound higher late in January.

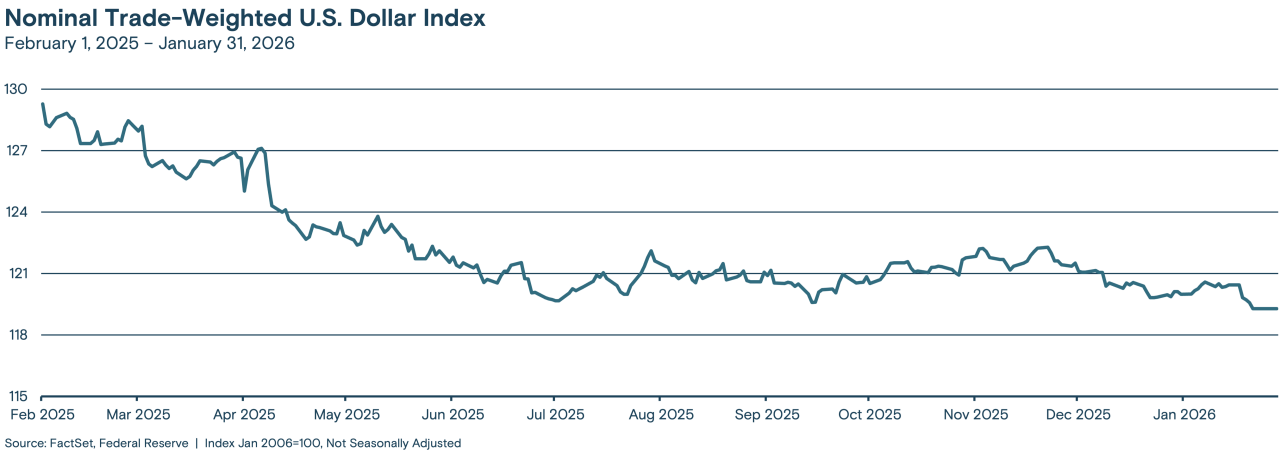

The Nominal Trade-Weighted U.S. Dollar Index fell 0.69% in January, reaching a new multi-year low, largely due to concerns about international investors and central banks lowering dollar exposure, tariff uncertainty, and ongoing concerns about Fed independence and the Fed’s ability to contain inflation.

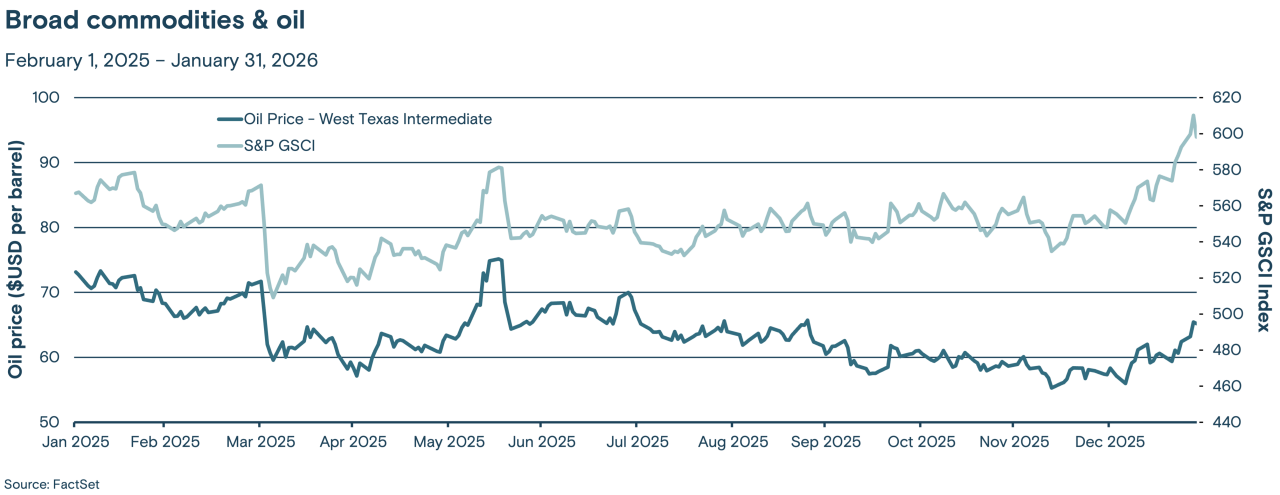

The S&P GSCI Index (a broad-based and production-weighted index representing the global commodity market) rose 9.06% in January. Gold prices surged, despite a sharp drop on the last day of the month, largely due to increased geopolitical risks, a weaker U.S. dollar and renewed trade tensions. The cost of a barrel of West Texas Intermediate (a grade of crude oil used as a benchmark in oil pricing) rose 13.57% over the month, primarily due to concerns about a potential conflict in Iran.

Media contact: Callie Briese, 612-844-7340; callie.briese@thrivent.com

All information and representations herein are as of 02/06/2026, unless otherwise noted.

The views expressed are as of the date given, may change as market or other conditions change, and may differ from views expressed by other Thrivent Asset Management, LLC associates. Actual investment decisions made by Thrivent Asset Management, LLC will not necessarily reflect the views expressed. This information should not be considered investment advice or a recommendation of any particular security, strategy or product. Investment decisions should always be made based on an investor's specific financial needs, objectives, goals, time horizon, and risk tolerance.

This article refers to specific securities which Thrivent Mutual Funds may own. A complete listing of the holdings for each of the Thrivent Mutual Funds is available on thriventfunds.com.

The S&P 500® Index is a market-cap weighted index that represents the average performance of a group of 500 large-capitalization stocks.

The Russell 2000® Index is an unmanaged index considered representative of small-cap stocks.

The Nasdaq Composite Index is a stock market index that includes almost all stocks listed on the Nasdaq stock exchange. The Nasdaq – National Association of Securities Dealers Automated Quotations – is an electronic stock exchange with more than 3,300 company listings.

The MSCI ACWI ex-USA Index is an unmanaged index considered representative of large- and mid-cap stocks across developed and emerging markets, excluding the U.S.

The Bloomberg U.S. Aggregate Bond Index is an unmanaged index considered representative of the U.S. investment-grade, fixed-rate bond market.

The Federal Funds effective rate is the interest rate at which depository institutions (mainly banks) lend reserve balances to other depository institutions overnight on an uncollateralized basis. In simpler terms, it's the rate banks charge each other for short-term loans to meet their reserve requirements.

The Consumer Confidence Index (CCI) is a survey administered by the Conference Board. The CCI measures what consumers are feeling about their expected financial situation, whether that's optimistic or pessimistic.

The University of Michigan Consumer Sentiment Index is a consumer confidence index published monthly by the University of Michigan.

The Chicago Purchasing Managers’ Index determines the economic health of the manufacturing sector in the Chicago region. A reading above 50 indicates expansion of the manufacturing sector; a reading below indicates contraction.

The Consumer Price Index measures the monthly change in prices paid by U.S. consumers for a basket of goods and services.

The Core Consumer Price Index (CPI) measures changes in the prices of goods and services, with the exclusion of food and energy.

The Personal Consumption Expenditures (PCE) Price Index, also known as consumer spending, is a measure of the spending on goods and services by people of the U.S.

The Core Personal Consumption Expenditures (PCE) Price Index, also known as consumer spending, is a measure of the spending on goods and services, excluding food and energy prices, by people of the U.S.

The Nominal Trade-weighted U.S. Dollar Index measures the value of the U.S. dollar based on its competitiveness versus trading partners.

The Institute for Supply Management Purchasing Managers Index (PMI) measures the month-over-month change in economic activity within the manufacturing sector.

Any indexes shown are unmanaged and do not reflect the typical costs of investing. Investors cannot invest directly in an index.

Past performance is not necessarily indicative of future results.