Retail sales remained resilient

Consumer confidence deteriorated over the year, but retail sales remained essentially robust. The University of Michigan’s Consumer Sentiment Index fell to 51.0 in November, just above the lowest level (50.0 in June 2022) in the index’s history, which dates to 1978. Additionally, consumer confidence in November, as measured by The Conference Board, declined for the fifth consecutive month. Nevertheless, in aggregate, consumer spending held up through 2025, supported by the higher-income tiers, which accounted for the bulk of total expenditures.

Employment weakened

The labor market showed increased signs of slowing in 2025, with reduced hiring and more frequent layoff announcements. The rise in unemployment also was partly due to people re-entering the labor force and actively seeking work but not finding it. The manufacturing sector was particularly weak, with seven straight months of declines, due in part to tariff-related uncertainty. Still, the related jobs data was mixed: the duration of unemployment continued to climb to levels typically seen in a recession, but weekly jobless claims remained relatively steady at a low level.

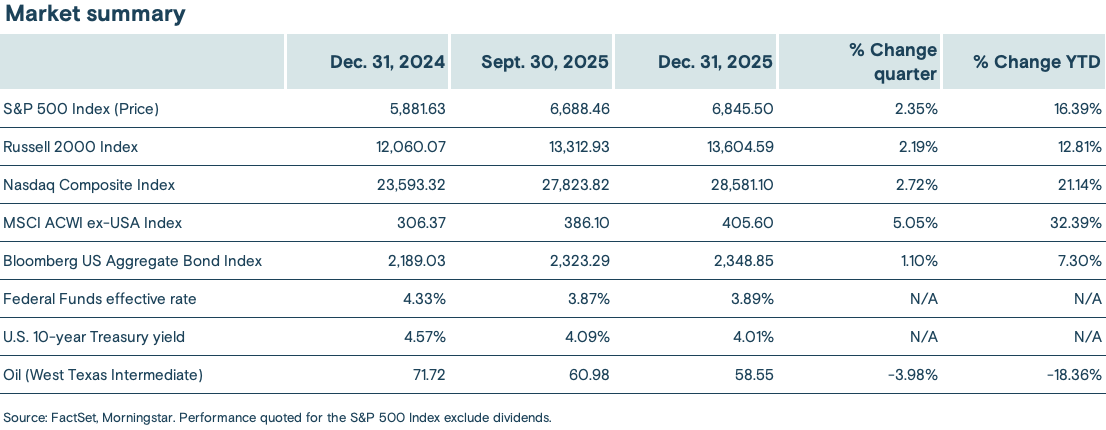

Treasury yields fell

The yield on 10-year U.S. Treasuries fell in 2025, from 4.57% at the start of the year to 4.17% at year end. Concerns about fiscal policy and the U.S. budget deficit put upward pressure on bond yields over the period, but relatively stable inflation and the Fed’s decision to lower interest rates by 0.75% late in the year supported bond returns. Credit spreads (the yield paid over comparable Treasury bonds) in investment-grade corporate bonds were largely unchanged over the year, near historical lows.

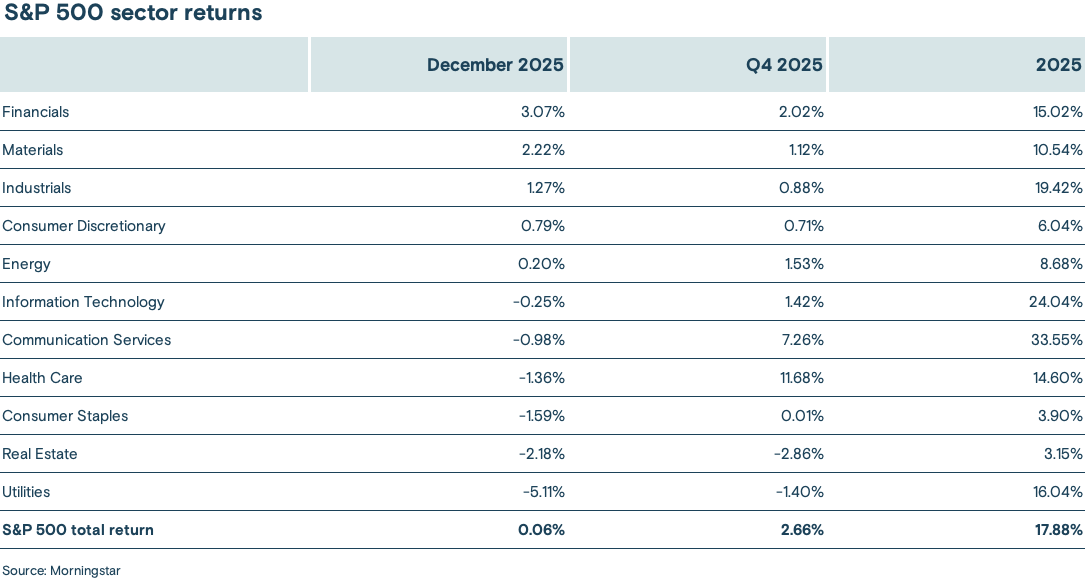

Corporate earnings projections rose

Corporate earnings projections for the S&P 500 Index rose steadily over the year. In the last few quarters, most companies exceeded earnings expectations despite the introduction of tariffs, leading to a steady pace of upward revisions from analysts. The strongest earnings were unusually concentrated, with the top 10 stocks in the S&P 500 Index accounting for an outsized share of total earnings growth.

Forward P/E ratios largely unchanged

Despite significant volatility in the first half of the year, the forward 12-month price-earnings ratio (P/E) of the S&P 500 Index was largely unchanged in 2025 at a relatively expensive level, changing from 21.39 at the start of the year to 22.00 at the end of December. A higher P/E means stocks are more expensive relative to their earnings per share. The forward 12-month earnings yield for the S&P 500 Index, which is the inverse of P/E, fell by 0.12% over the year. The 12-month forward earnings yield can help compare equity earnings yields with current bond yields. At December’s end, the 4.55% equity earnings yield remained above the 4.17% yield 10-year U.S. Treasuries offered, but the gap narrowed.

The U.S. dollar weakened

The Nominal Trade-Weighted U.S. Dollar Index fell 7.57% in 2025, its sharpest annual decline in eight years. Narrowing interest-rate differentials (the gap between U.S. and foreign bond yields), policy uncertainty and concerns over the Fed's independence all weighed on the currency in the first half of the year. In the third and fourth quarters, the U.S. dollar was more stable, supported by an improving economic growth outlook and lower expectations for interest-rate cuts.

Oil prices slid, gold surged

The price of a barrel of West Texas Intermediate (WTI), a grade of crude oil used as a benchmark in oil pricing, fell 18.36% to $58.55 in 2025, continuing its decline from its peak in mid-2022 when the price exceeded more than $100 a barrel. The decline is largely attributable to oversupply with too much production along with expectations that the demand for oil will slow, creating an abundance of supply. The price of gold surged to a new all-time high, rising above $4,500 an ounce, a gain of more than 70% over the year. A multitude of factors supported gold, including uncertainty around U.S. trade and fiscal policy, demand from the world’s central banks as they sought to diversify their holdings, escalating geopolitical tensions and U.S. interest rate cuts.

International equities outperformed

The MSCI ACWI ex-USA Index, which tracks stocks across developed and emerging-market economies across the world (excluding the U.S.), rose 32.39% in 2025, significantly outperforming the S&P 500 Index. However, much of the MSCI ACWI’s returns were driven by U.S. dollar weakness that occurred in the first half of the year. Asian markets, excluding China, were particularly strong on the back of enthusiasm for AI. For example, Korean equities rose just over 100% in 2025, in U.S. dollar terms. Emerging-market equities were also notably strong, with Latin America seeing a regional gain above 50%, in U.S. dollar terms.

What can you expect from the economy and the markets in the months ahead? See: A return to normal?, by Chief Investment Strategist, Steve Lowe, Head of Mixed Asset and Market Strategies, David Spangler and Head of Fixed Income, Kent White.