![The benefits of managed portfolios [PODCAST]](/content/dam/thrivent/fp/fp-insights/advisors-market360-podcast/advisors-market360-podcast-16x9-branding-insights-card.jpg/_jcr_content/renditions/cq5dam.web.1280.1280.jpeg)

The benefits of managed portfolios [PODCAST]

Why they may be a good idea for clients and an even better idea for financial advisors.

Why they may be a good idea for clients and an even better idea for financial advisors.

02/27/2026

DECEMBER 2025 MARKET UPDATE

12/05/2025

Investors may want to consider rotating from cash to Treasuries and/or corporate bonds.

Thrivent Asset Management contributors to this report: John Groton, Jr., CFA, director of administration and materials & energy research; Matthew Finn, CFA, head of equity mutual funds; and Charles Hofstrom, CFA, investment product manager

Equities ended the month with modest gains, however tech stocks and bond yields eased.

Holiday spending and year-end positioning often result in strong equity performance in December.

Inflation is still above the Fed’s 2% target, and we expect the Fed will cut rates again in December.

The economy: Economic data was limited over the month due to the U.S. government shutdown, but the data released was mixed. Manufacturing data remains soft, consumer confidence has continued to fall, while reported corporate earnings were again strong and the September employment data reported a strong rebound in job growth. While expectations for the U.S. Federal Reserve (Fed) to cut interest rates by another 0.25% in December dipped early in the month, they rebounded by month end.

Stocks: Despite significant mid-month volatility, the S&P 500® Index rose a modest 0.13% in November, its seventh consecutive monthly gain. However, the information technology sector was the worst-performing sector (down 4.29%), and the Nasdaq Composite Index fell 1.45% over the month, reflecting apprehension about technology companies' ability to recoup their considerable investment in artificial intelligence (AI).

Bonds: Benchmark 10-year Treasury yields declined modestly in November, from 4.09% to 4.01%, as expectations grew for the Fed to cut rates a further 0.25% at its December meeting. Corporate bond markets also began to show some weariness with the pace and volume of corporate borrowing, particularly companies borrowing to fund AI initiatives. Investment-grade bonds remained relatively stable on a yield and spread basis, but the high-yield market saw yields decline over the period. The Bloomberg U.S. Aggregate Bond Index rose 0.62% in November, bringing its year-to-date gain to 7.46%.

The economy: We remain cautious about forecasting significant changes in long-term economic trends based on relatively short-term data, particularly given the absence of key economic data releases. The decline in consumer confidence and manufacturing activity is a potential cause for concern, while the extent of weakness in the employment market remains unclear, though continues to show signs of slowing. Still, we expect the economy to find support from strong corporate earnings, a relatively low unemployment rate, lower interest rates, tax cuts, deregulation and an expansionary fiscal policy.

While the possibility of a recession persists, our base case remains that growth will moderate from its 2025 rate, but the economy will avoid a recession

Stocks: We maintain a modest overweight position in equities over fixed income given our structurally positive long-term outlook for the economy and our bias toward prioritizing economic fundamentals and corporate earnings as the primary determinants of investment returns over the long term. But valuations are high, and we expect the markets will be watching large-cap technology companies closely for evidence they can monetize their investment in AI and deliver strong earnings growth.

Maintain exposure, favoring higher-quality and large-cap stocks

Bonds: Interest-rate cuts are likely to occur incrementally over a longer period than the markets have anticipated. But, as the inflation rate seems increasingly likely to absorb higher tariffs without rising significantly, we expect lower interest rates in the months and quarters ahead. This suggests continuing to favor shorter-maturity Treasury securities, which are most sensitive to Fed rate cuts. In the corporate credit market, valuations are rich with tight credit spreads, which leads us to favor higher-quality corporate bonds in the current environment.

Stay at the short end of the Treasury curve and favor higher-quality corporate bonds with less exposure to tariff uncertainty and macroeconomic weakness

Economic data was again scarce in November as most government agencies either postponed or released only partial data. However, the Institute for Supply Management (ISM) Manufacturing Purchasing Managers’ Index (PMI) fell to 48.2 from 48.7 in October. The ISM PMI is constructed to signal that any measure below 50 indicates contraction, and November’s figure marked the ninth consecutive month the U.S. manufacturing sector has been contracting. Additionally, the Chicago Purchasing Managers’ Index dropped sharply from 43.8 in October to 36.3 in November.

November’s U.S. retail sales report was not published due to the government shutdown. However, the University of Michigan’s Consumer Sentiment Index fell again from 53.6 in October to 51.0 in November, just above the lowest level (50.0 in June 2022) in the index’s history, which dates to 1978. Additionally, consumer confidence in November, as measured by The Conference Board, fell by the most in seven months.

The September employment report from the Bureau of Labor Statistics (BLS), released in late November, showed 119,000 new jobs were created, exceeding expectations and reversing the decline in new jobs reported in August. However, the unemployment rate rose to 4.4% from 4.3% in August, which was up from 4.2% in July. According to data released by the Cleveland Fed, large-scale layoffs rose, including job cuts by Verizon, which indicated it may cut roughly 20% of its workforce. According to the BLS, October’s unemployment rate will not be reported, but the month’s payroll data will be incorporated into November’s report, due to be published on Dec 16.

October’s Consumer Price Index (CPI) data was not released in November due to the government shutdown. However, September’s Personal Consumption Expenditures (PCE) Price Index data was released on Dec 5. Relative to September 2024, core PCE (which excludes the more volatile food and energy sectors) rose 2.8%, which was in line with consensus estimates. Relative to August, core PCE rose 0.2%, its third consecutive monthly rise of 0.2%, suggesting that inflation remains relatively stable.

RELATED CONTENT

RELATED ARTICLE

Understand the strategic, operational and customer-centric approach our value financial professionals use to help drive success in their funds.

RELATED PODCAST

Spending on AI infrastructure continues at a breakneck pace. Will this growth continue?

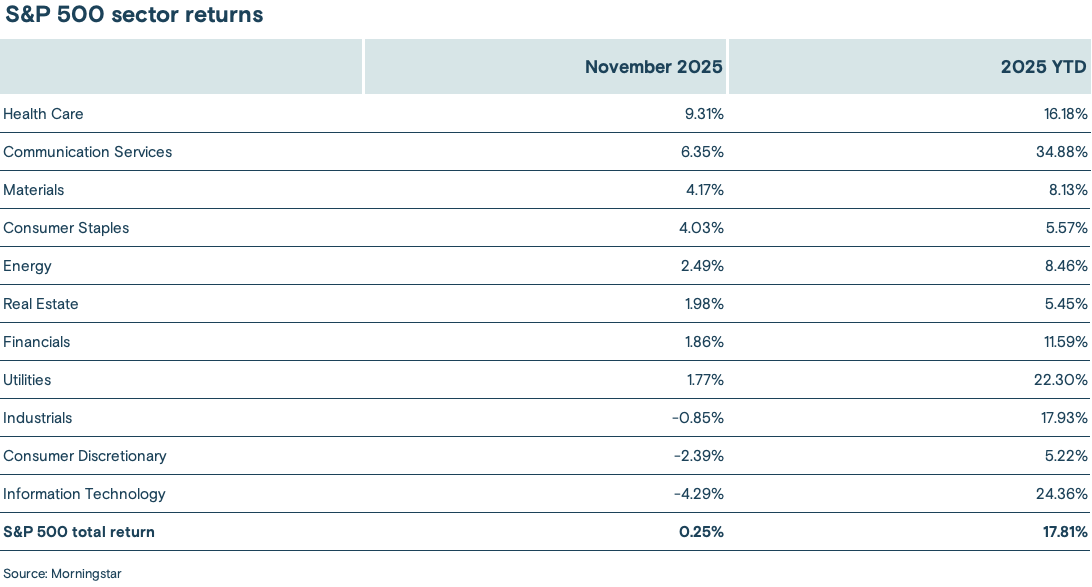

Despite significant intra-month volatility, U.S. stocks ended November modestly higher, with the benchmark S&P 500 Index of large-cap stocks increasing 0.13%, boosting its year-to-date gain to 16.45%. Third-quarter earnings season wrapped up in November, with 81% of S&P 500 companies beating consensus estimates. Information technology was the worst-performing sector in November (down 4.29%), despite Nvidia Corporation, the leading manufacturer of AI and supercomputing chips, reporting strong earnings. Health care (up 9.31%) led the S&P 500 Index higher, with support from more defensive sectors like utilities (up 1.77%) and more interest-rate sensitive sectors like real estate (up 1.98%) and financials (up 1.86%).

The table below shows the past month and year-to-date performance results of the 11 sectors:

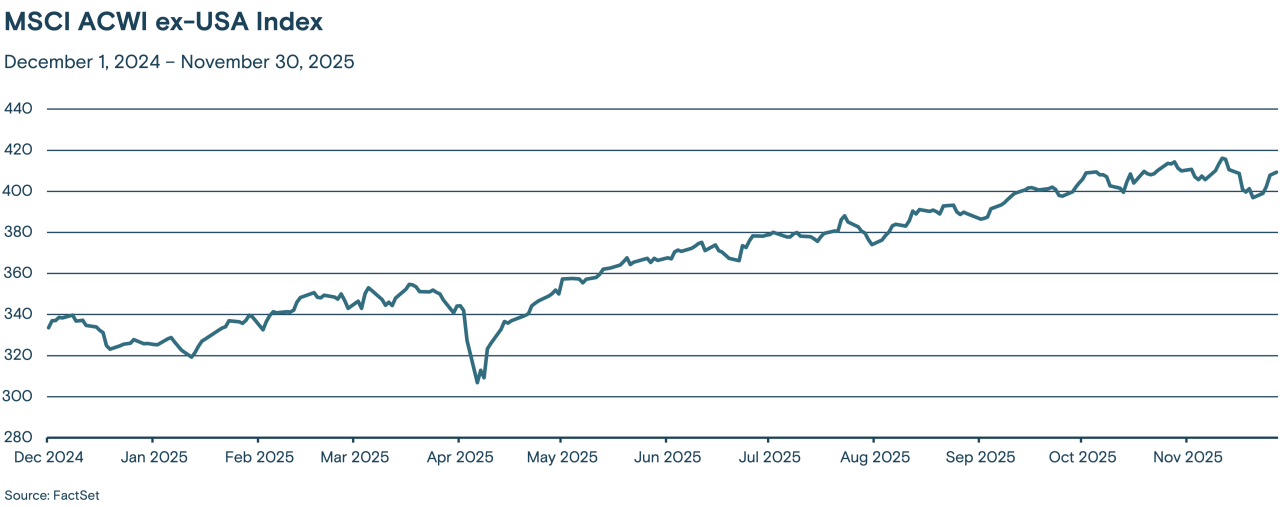

The MSCI ACWI ex-USA Index, which tracks stocks across developed and emerging-market economies across the world (excluding the U.S.), set a new high in November but closed the month down 0.03%, marginally underperforming the S&P 500 Index. European equities were relatively strong, supported by expectations of strong earnings growth in the coming year, while a weaker yen bolstered Japanese stocks. Year to date, the MSCI ACWI ex-USA Index is up 28.53%.

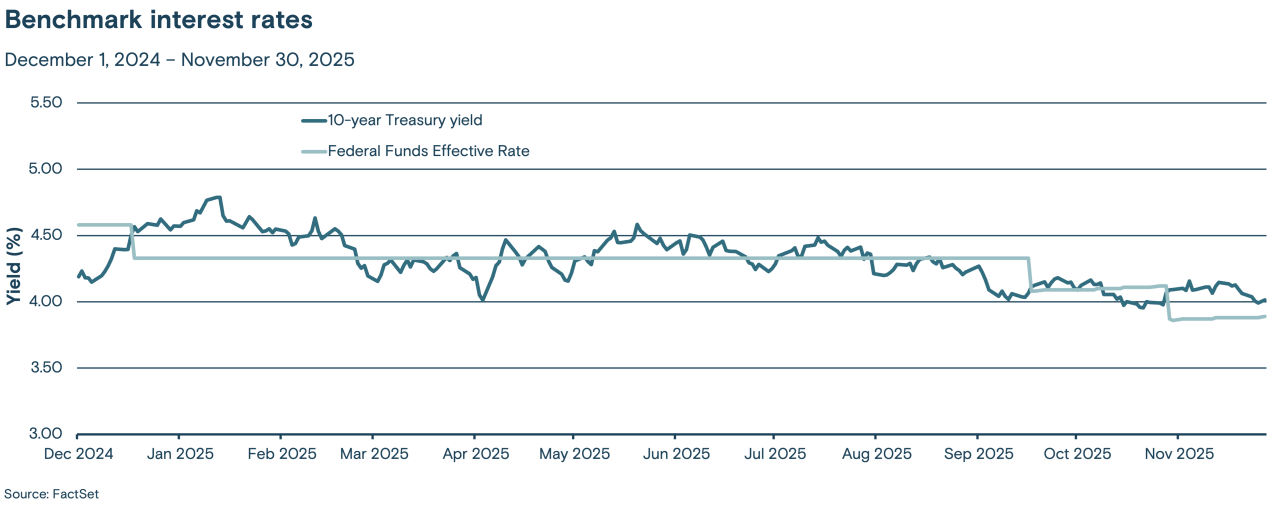

Benchmark 10-year Treasury yields ended November at 4.01%, 0.08% below their yield at the end of October. While the government shutdown reduced the amount of economic data bond investors rely on, weaker labor and consumer confidence data, along with public comments from Fed officials, led markets to price in a higher probability that the Fed will cut interest rates by another 0.25% at its December meeting.

An abundance of supply in investment-grade corporate bonds, more recently from technology companies, prompted some caution in November. Investment-grade yield spreads (the amount of yield paid over comparable U.S. Treasuries) remain well below their average over the last decade. High-yield bonds (those that carry a sub-investment-grade credit rating) saw the credit spreads decline over the month , although credit spreads on the lowest-rated bonds increased.

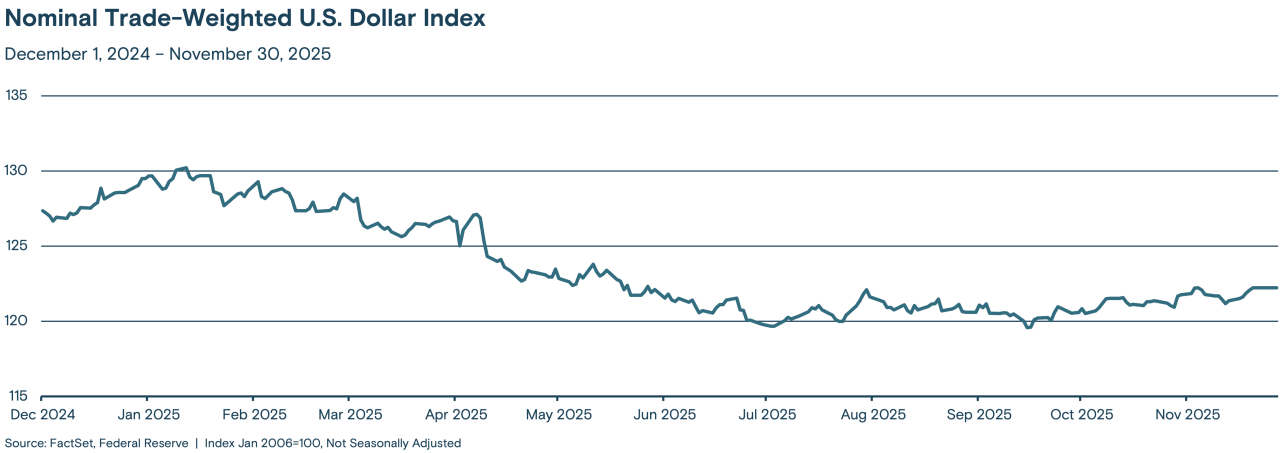

The Nominal Trade-Weighted U.S. Dollar Index rose 0.38% in November, largely due to rising confidence in the stability of the currency. Year to date, the trade-weighted U.S. dollar has fallen by 5.6%, but it has been slowly recovering since July as economic growth has remained relatively stable and expectations for further interest rate declines have been modest.

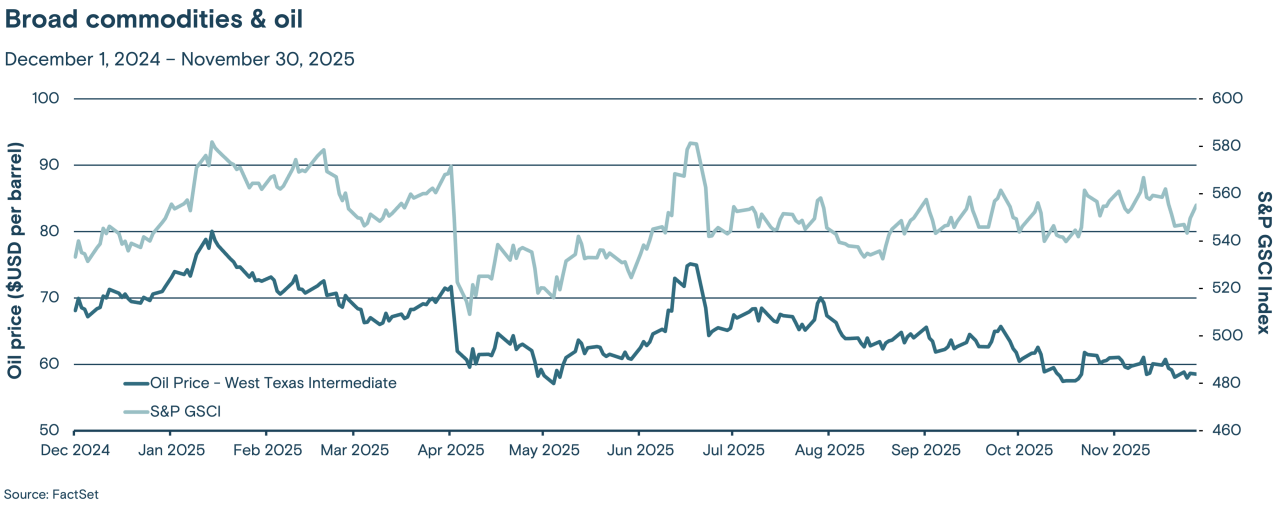

The S&P GSCI Index (a broad-based and production-weighted index representing the global commodity market) fell 0.33% in November. Gold prices rebounded in November, partly due to expectations that the Fed was increasingly likely to cut interest rates in December and that it might start reserve management purchases of Treasury bills (short-term Treasuries) to boost bank reserves and increase liquidity. The cost of a barrel of West Texas Intermediate (a grade of crude oil used as a benchmark in oil pricing) fell 3.98% over the month, primarily due to expectations that the demand for oil will slow, creating an abundance of supply.

Media contact: Callie Briese, 612-844-7340; callie.briese@thrivent.com

All information and representations herein are as of 12/05/2025, unless otherwise noted.

The views expressed are as of the date given, may change as market or other conditions change, and may differ from views expressed by other Thrivent Asset Management, LLC associates. Actual investment decisions made by Thrivent Asset Management, LLC will not necessarily reflect the views expressed. This information should not be considered investment advice or a recommendation of any particular security, strategy or product. Investment decisions should always be made based on an investor's specific financial needs, objectives, goals, time horizon, and risk tolerance.

This article refers to specific securities which Thrivent Mutual Funds may own. A complete listing of the holdings for each of the Thrivent Mutual Funds is available on thriventfunds.com.

The S&P 500® Index is a market-cap weighted index that represents the average performance of a group of 500 large-capitalization stocks.

The Russell 2000® Index is an unmanaged index considered representative of small-cap stocks.

The Nasdaq Composite Index is a stock market index that includes almost all stocks listed on the Nasdaq stock exchange. The Nasdaq – National Association of Securities Dealers Automated Quotations – is an electronic stock exchange with more than 3,300 company listings.

The MSCI ACWI ex-USA Index is an unmanaged index considered representative of large- and mid-cap stocks across developed and emerging markets, excluding the U.S.

The Bloomberg U.S. Aggregate Bond Index is an unmanaged index considered representative of the U.S. investment-grade, fixed-rate bond market.

The Federal Funds effective rate is the interest rate at which depository institutions (mainly banks) lend reserve balances to other depository institutions overnight on an uncollateralized basis. In simpler terms, it's the rate banks charge each other for short-term loans to meet their reserve requirements.

The Consumer Confidence Index (CCI) is a survey administered by the Conference Board. The CCI measures what consumers are feeling about their expected financial situation, whether that's optimistic or pessimistic.

The University of Michigan Consumer Sentiment Index is a consumer confidence index published monthly by the University of Michigan.

The Chicago Purchasing Managers’ Index determines the economic health of the manufacturing sector in the Chicago region. A reading above 50 indicates expansion of the manufacturing sector; a reading below indicates contraction.

The Consumer Price Index measures the monthly change in prices paid by U.S. consumers for a basket of goods and services.

The Core Consumer Price Index (CPI) measures changes in the prices of goods and services, with the exclusion of food and energy.

The Personal Consumption Expenditures (PCE) Price Index, also known as consumer spending, is a measure of the spending on goods and services by people of the U.S.

The Core Personal Consumption Expenditures (PCE) Price Index, also known as consumer spending, is a measure of the spending on goods and services, excluding food and energy prices, by people of the U.S.

The Nominal Trade-weighted U.S. Dollar Index measures the value of the U.S. dollar based on its competitiveness versus trading partners.

The Institute for Supply Management Purchasing Managers Index (PMI) measures the month-over-month change in economic activity within the manufacturing sector.

Any indexes shown are unmanaged and do not reflect the typical costs of investing. Investors cannot invest directly in an index.

Past performance is not necessarily indicative of future results.