![The benefits of managed portfolios [PODCAST]](/content/dam/thrivent/fp/fp-insights/advisors-market360-podcast/advisors-market360-podcast-16x9-branding-insights-card.jpg/_jcr_content/renditions/cq5dam.web.1280.1280.jpeg)

The benefits of managed portfolios [PODCAST]

Why they may be a good idea for clients and an even better idea for financial advisors.

Why they may be a good idea for clients and an even better idea for financial advisors.

02/27/2026

FUND COMMENTARY

12/05/2025

Investors may want to consider rotating from cash to Treasuries and/or corporate bonds.

Thrivent Asset Management contributors to this report: Kurt Lauber, CFA, Thrivent Large Cap Value Fund portfolio manager; Graham Wong, CFA, Thrivent Mid Cap Value ETF portfolio manager; and Christopher Parker, CFA, Thrivent Small Cap Value ETF portfolio manager

Despite rapid market shifts, the fundamental principles of buying strong businesses below intrinsic value continue to deliver long-term results.

Focusing on return on invested capital and management discipline helps avoid value traps and exploit short-term mispricing.

With valuations stretched in certain sectors and the economic cycle broadening, we believe value strategies are well-positioned to capture emerging opportunities.

With the proliferation of speculative asset classes and legions of stock traders chasing profits in fractions of a second, value investing has become one of the more debated approaches in the market. Recent periods of underperformance have raised questions about whether value investing still has a role in a world increasingly dominated by innovation, intangibles and momentum. Yet, in our experience, value’s relevance endures because of the simple idea that the search for mispriced opportunity is timeless.

At its core, value investing is about buying a business for less than it is worth based on the present value of its future cash flows. Many observers associate value with traditional valuation metrics like price-to-earnings or price-to-book ratios, and while these can be helpful reference points, they tell only part of the story. They do not reveal the durability of a company’s returns or the market’s misunderstanding of its long-term potential.

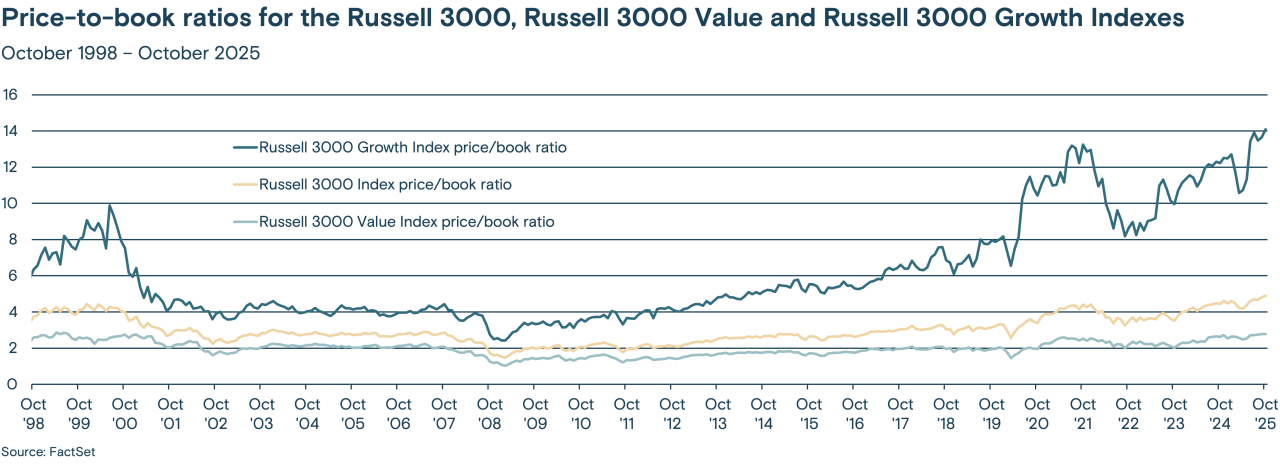

Over the past two decades, the market’s preference for growth over value has grown extreme. As the charts below show, growth stocks have steadily pulled away from value stocks in both valuation and profitability measures. The widening gap underscores how sentiment and momentum have driven much of the divergence. For value investors, these kinds of dislocations are fertile ground.

At Thrivent Asset Management, we believe the foundation of value investing lies in understanding return on invested capital (ROIC), a measure of how efficiently a business converts capital into profits. Companies that consistently generate returns above their cost of capital create economic value over time. When those businesses trade at prices that underestimate the persistence or improvement of those returns, they can offer compelling opportunities for disciplined investors.

In our view, true value investing is less about identifying “cheap” stocks and more about identifying high-quality or improving businesses that are temporarily misjudged by the market.

Across our large-, mid- and small-cap value strategies, we apply a consistent investment framework designed to uncover attractive risk-adjusted returns. It centers on three interrelated dimensions: operations, valuation and catalyst.

Operations: Understanding the business

We begin by assessing business quality. This includes evaluating profitability, cash flow generation, balance sheet strength and the sustainability of competitive advantages. A company’s ability to generate strong or improving returns on capital is the clearest signal of value creation.

We also closely assess the “direction of travel.” An average company where fundamentals are improving can often offer better prospective returns than a strong company with fading trends.

Valuation: Measuring intrinsic worth

Valuation is not a single-point estimate; it reflects a range of potential outcomes. We analyze scenarios to understand where downside risk lies and how asymmetric the return potential may be. Our goal is to invest when the expected upside meaningfully outweighs potential downside — what we call a favorable risk-reward asymmetry. In other words, where we believe a substantial margin of safety exists that offers meaningful return potential if our assessment of valuation is correct and limited downside if we are wrong.

Intrinsic value is determined through multiple approaches, including discounted cash flow models and normalized earnings analysis. What matters most is not necessarily relative valuation versus peers, but whether consensus is pricing in an overly pessimistic or optimistic set of assumptions about the company’s future.

Catalyst: Unlocking the value gap

Finally, we look to identify what triggers could close the gap between price and value. Catalysts may include management changes, evidence of operational turnarounds, regulatory shifts or industry consolidation. Without a credible catalyst, even a high-quality business can remain undervalued for years.

Low valuation multiples can be enticing, but they are not synonymous with opportunity. Many low-priced stocks remain permanently cheap because their industries are structurally challenged, their balance sheets are overleveraged or their business models are deteriorating.

We aim to avoid these value traps by insisting on two conditions: 1) the company must have sound or improving operations, and 2) there must be a credible catalyst for revaluation.

Our discipline often means passing on seemingly “cheap” opportunities that lack these traits. Over time, avoiding permanent capital impairment matters more than capturing every rebound.

Our process is deeply fundamental and bottom-up. We rely heavily on both quantitative and qualitative research to understand a company’s true economic drivers.

Analysts and portfolio managers construct detailed financial models that decompose ROIC into its building blocks: profit margins, asset turnover and capital intensity. This helps isolate which drivers are improving and which may be under pressure. We complement this analysis with extensive fieldwork, which includes speaking with management teams, customers, suppliers and competitors to test and refine our assumptions.

We are not simply looking for companies that meet statistical criteria for value. We are looking for dislocations between perception and reality, particularly when a company’s fundamentals are inflecting in a positive direction that the market has yet to recognize.

Our focus on ROIC also guides our risk management. A company earning returns above its cost of capital generally has more flexibility to navigate downturns, reinvest profitably and withstand market volatility. In our view, this emphasis on quality within value is what differentiates our strategies.

While no two investments are identical, several holdings across our value portfolios illustrate how this process works in real time.

Entergy Corp. – Recognizing hidden improvement in a utility business

Entergy, held by Thrivent Large Cap Value Fund, illustrates how our process can uncover value when sentiment is depressed but fundamentals are quietly strengthening. Storm-related costs from Hurricane Ida created headline risk and delayed regulatory recovery, leaving investors focused on near-term noise rather than underlying economics. Our work dug into the regulatory docket, securitization timelines and allowed return on investments across Entergy’s jurisdictions. This analysis showed that recent approvals in Louisiana—plus a pending decision in Texas related to EV-charging riders—support both balance-sheet repair and multi-year, rate-base growth.

Our industry work also identified a powerful demand catalyst: accelerating industrial and data-center load growth in the Gulf South. Entergy’s pipeline of 5–10 GW of data-center projects and rising electrification needs provide incremental visibility into long-term earnings power—none of which is adequately reflected in valuation. Entergy represents the type of undervalued, fundamentally improving business our process is designed to surface.

The Flowserve Corp. – Identifying operational turnaround

Flowserve, held by Thrivent Mid Cap Value ETF, is a good example of our focus on companies with tangible self-help and improving business quality. Our analysis highlighted two durable drivers: a growing aftermarket business with structurally higher margins, and a multiyear operational turnaround supported by management discipline. The company has delivered more than 500 basis points of margin expansion over two years, with aftermarket revenue now exceeding 50% of sales—a strong indicator that Flowserve is monetizing its installed base effectively.

We evaluated the Flowserve Business System and determined that initiatives such as lean manufacturing, SKU and customer rationalization, and better pricing discipline provide continued room for margin improvement. These programs are measurable, sequenced and already translating into higher free cash flow, important markers of an improving operating thesis.

Supported by strong cash generation, a cleaner balance sheet and targeted M&A to strengthen niche product lines, Flowserve demonstrates the characteristics we seek: a fundamentally solid industrial franchise undergoing self-directed operational improvement, with upside that the market has not fully priced in.

Gates Industrial Corp. plc – Valuing structural progress

Gates Industrial, held by Thrivent Small Cap Value ETF, also illustrates our preference for companies where underlying fundamentals are improving faster than market expectations. Gates profitability and revenue growth were pressured following supply chain disruptions and weak demand during 2022 and 2023. However, the company was implementing a number of programs to improve structural profitability and growth.

Our due diligence of the company’s margin improvement efforts included discussions with numerous former employees and customers as well as the company. This work led us to believe that management’s plans for improvements in strategic sourcing, material-science innovation and value analysis/value engineering (VAVE) initiatives would yield greater-than-anticipated sustainable improvements in profitability and returns.

Our due diligence also included evaluating changes in Gates’ approach to product development and efforts to improve customer alignment so we could identify and target growth opportunities. This work identified a number of new market opportunities such as an early but meaningful exposure to data-center liquid cooling, a fast-growing, technically demanding market well suited to Gates’ materials and fluid-power expertise. While current revenue contribution is small, the addressable market is large, and we believe the company is positioned to benefit as AI-driven, thermal-management requirements expand.

Despite this improving operating picture and a return to roughly 40% gross margins, valuation remains well below peers. That combination—credible margin expansion, emerging secular growth opportunities and a discounted multiple—fits squarely within our process for identifying substantial undervaluation with attractive asymmetry.

RELATED VIDEOS

Meet the fund managers: Thrivent Mid Cap Value ETF

Thrivent Mid Cap Value ETF fund managers use operations, valuation and catalysts to unlock value.

Meet the fund managers: Thrivent Small Cap Value ETF

Thrivent Small Cap Value ETF fund managers employ a high-conviction, risk-aware approach for managing this fund.

In a world increasingly focused on quarterly performance, patience has become a more substantial competitive advantage in investing. Our investment horizon typically spans three to five years, providing fundamental improvements a runway to unfold.

We view time as an ally. A business compounding its intrinsic value at 10% annually can create significant long-term wealth, even if price appreciation lags in the near term. This concept of time arbitrage — capitalizing on the market’s short-term focus — remains central to our philosophy.

Short-term volatility has generally increased over time, and this increase is often viewed negatively. However, we are mindful that price swings often reflect emotion rather than material changes in intrinsic value and often create the type of mispricing we seek as value investors. Thus, we see volatility as an opportunity to accumulate positions when sentiment disconnects from fundamentals.

When management ownership is meaningful and compensation is tied to value-based metrics such as ROIC or free cash flow per share, we believe the likelihood of long-term success rises. Conversely, companies led by teams focused on short-term earnings or aggressive financial engineering often carry greater risk of underperformance.

Evaluating management quality requires judgment and context. It is not only about assessing competence, but about understanding behavior under pressure. In other words, how leaders respond when conditions deteriorate. That insight often determines whether a company compounds or erodes value over time.

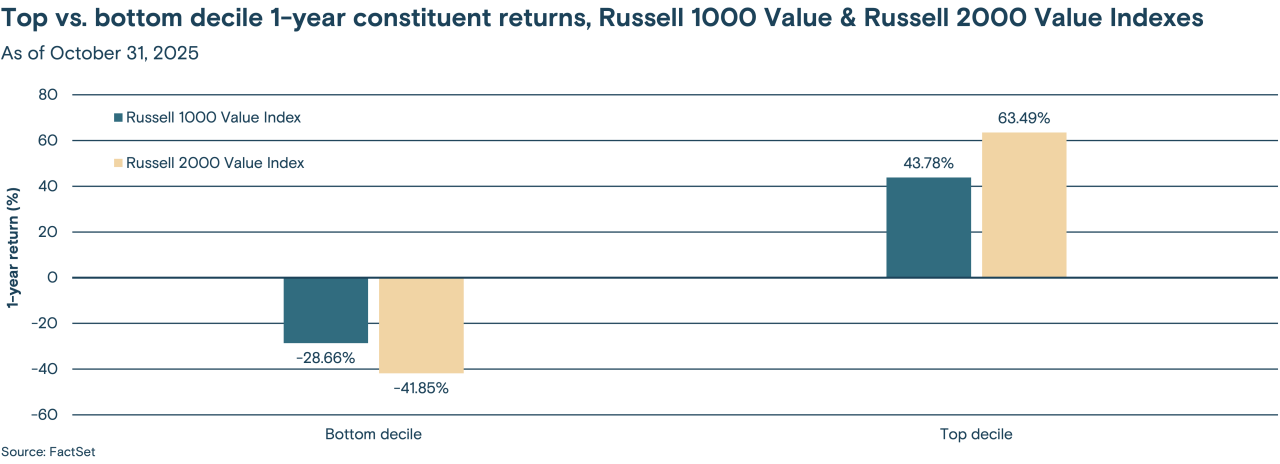

Each capitalization range offers distinct characteristics and opportunities.

While the opportunity set varies, our process and philosophy remain consistent across all three strategies.

Value investing tends to outperform when the economic cycle broadens and capital rotates toward underappreciated sectors. Periods following rate-cut cycles or economic recoveries often favor value styles, as earnings momentum widens beyond narrow market leadership.

Today’s environment shows some early signs of such a transition. Inflation is moderating, the U.S. Federal Reserve has pivoted to a more dovish policy and global growth is stabilizing. Historically, these inflection points have supported value stocks, particularly in cyclical sectors like financials, industrials and energy.

At the same time, valuation dispersion between growth and value remains elevated by historical standards. We believe this dispersion creates a fertile landscape for active, bottom-up investors.

The perception that value investing has minimal exposure to innovation is misguided. Many of today’s most durable value opportunities sit behind the technologies shaping tomorrow, including companies supplying the infrastructure, energy, components and logistics that enable digital transformation.

For example, the rapid build-out of artificial intelligence infrastructure is increasing demand for reliable power and advanced cooling systems. That dynamic supports companies across the industrial and utilities landscape — areas where value investors have long operated.

Value investing, at its best, identifies the economic enablers of progress, not just the disruptors.

Across our value strategies, performance has been driven by stock selection rather than macro positioning. Over the long term, value’s advantage stems from buying fundamentally strong businesses at discounts, allowing intrinsic value growth to compound across market cycles.

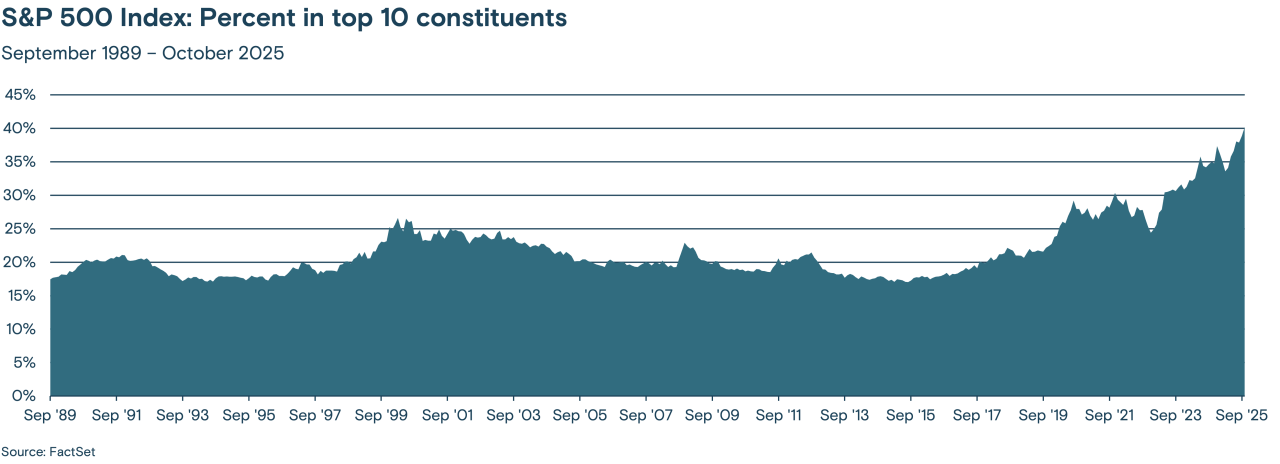

In our view, the current market environment reinforces the case for maintaining balance with value exposure. Valuation spreads remain wide, macro conditions appear supportive and investor sentiment continues to narrow around a small set of mega-cap growth companies. The result is an equity market that is becoming increasingly top-heavy, heightening concentration risk in many passive portfolios. Allocating to attractively valued companies with tangible earnings and disciplined management can help diversify away from this growing dependence on a handful of names.

Markets evolve, technologies transform, and cycles come and go. Through it all, the core principles of value investing — discipline, patience and independent thinking — remain unchanged.

Our focus is on buying strong, improving businesses at prices that underestimate their long-term earnings power and holding them until fundamentals and perception align.

In an investing world increasingly driven by headlines and algorithms, we continue to believe that value is found not in the noise, but in the numbers.

Media contact: Callie Briese, 612-844-7340; callie.briese@thrivent.com

All information and representations herein are as of 12/05/2025, unless otherwise noted.

The views expressed are as of the date given, may change as market or other conditions change, and may differ from views expressed by other Thrivent Asset Management, LLC associates. Actual investment decisions made by Thrivent Asset Management, LLC will not necessarily reflect the views expressed. This information should not be considered investment advice or a recommendation of any particular security, strategy or product. Investment decisions should always be made based on an investor's specific financial needs, objectives, goals, time horizon, and risk tolerance.

This article refers to specific securities which Thrivent Mutual Funds and Thrivent ETFs may own. A complete listing of the holdings for each of the funds is available on thriventfunds.com.

Russell 3000® Index is a stock market index that tracks the performance of the 3,000 largest publicly traded companies in the U.S., representing about 98% of the investable U.S. stock market.

Russell 3000® Value Index is a market-capitalization weighted equity index including stocks from the Russell 3000 Index with lower price-to-book ratios and lower expected growth rates.

Russell 3000® Growth Index is a market-capitalization weighted equity index including stocks from the Russell 3000 Index that display signs of above-average growth.

Russell 1000® Value Index is an unmanaged index considered representative of large-cap value stocks.

Russell 2000® Value Index is an unmanaged index considered representative of small-cap value stocks.

The S&P 500® Index is a market-cap weighted index that represents the average performance of a group of 500 large-capitalization stocks.

Any indexes shown are unmanaged and do not reflect the typical costs of investing. Investors cannot invest directly in an index.

Past performance is not necessarily indicative of future results.

As of 8/29/2025, Thrivent Lage Cap Value Fund holds 1.94% of Entergy Corporation, Thrivent Mid Cap Value ETF holds 0.77% of Flowserve Corporation, and Thrivent Small Cap Value ETF holds 1.97% of Gates Industrial Corporation plc.

Follow these links to see the top 10 holdings for Thrivent Large Cap Value Fund, Thrivent Mid Cap Value ETF and Thrivent Small Cap Value ETF.

TSCV (small cap value) Prior to close of business on 11/14/2025, this ETF operated as an open-end mutual fund with the same investment objective, strategy, and investment adviser. The mutual fund’s inception date was 03/31/2022.

TMVE (mid cap value) Prior to close of business on 11/14/2025, this ETF operated as an open-end mutual fund with the same investment objective, strategy, and investment adviser. The mutual fund’s inception date was 02/28/2020.