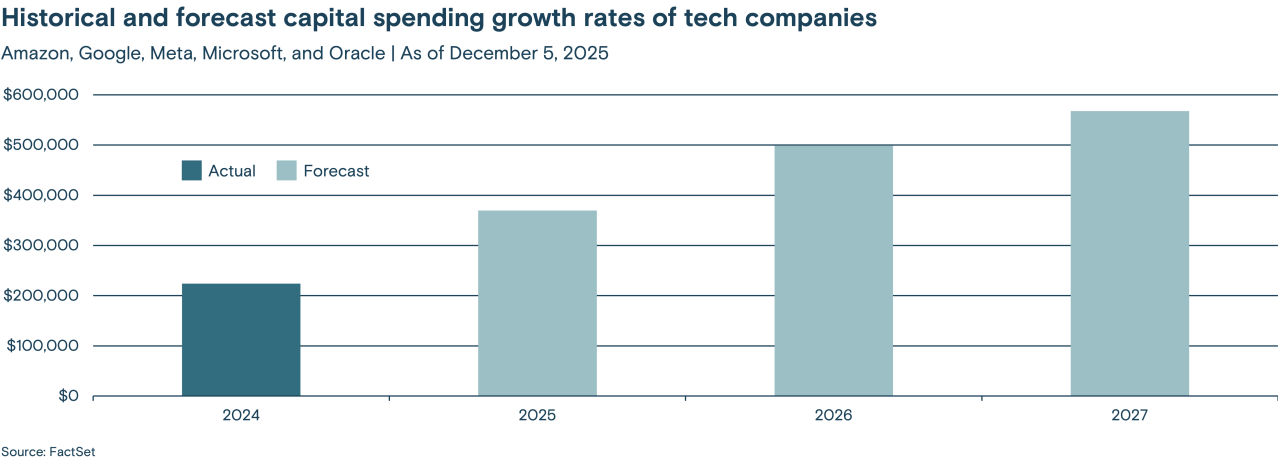

While there has been some concern about the sustainability of this growth, we agree with the market consensus that spending growth will grow substantially next year and is more likely to exceed consensus expectations than to miss them. In our research and interviews with companies across the AI infrastructure supply chain, the consensus capital spending plans may well prove to be conservative.

For example, the Taiwanese electronics manufacturer Foxconn expects requests for the physical racks that hold the servers powering AI to likely double between 2025 and 2026, suggesting investment in servers may also double. Meanwhile, Meta Platforms (commonly known as “Meta”) recently reported it is running up against capacity constraints as it tries to power its existing products while also training new AI models. Also, Microsoft reported that customer demand is driving its plans to double its data center footprint in the next two years.

Beyond semiconductors and servers, there is also a need for greater computer networking and storage space to maximize performance. In the networking space, we believe companies like U.S. computer networking company Arista Networks, U.S. provider of cable and interconnect systems Amphenol and Canadian electronics manufacturing services company Celestica are well positioned to succeed. In the storage sector, which includes memory chips and hard drives, companies like U.S. manufacturer Micron Technology and Korean-based Samsung Group are particularly well positioned for sustained growth. Pricing for memory chips has been particularly robust, in part due to a structural trend in smart devices (from refrigerators to doorbells) as well as from the cyclical demand from AI infrastructure construction.

AI-empowered software has room for enormous growth

As software applications get built on top of AI’s physical infrastructure, a range of services can be deployed, allowing a different set of companies to potentially benefit. The most immediate opportunity lies in infrastructure software. These applications come from companies that work closely with large-scale data centers, often referred to as hyperscalers. Companies like the middle-market U.S. analytics and software company Datadog are very active in this category, while larger companies such as Microsoft and Oracle also offer infrastructure software.

Beyond infrastructure software, the larger market is for specialized application software. While well-known companies like Salesforce, ServiceNow and HubSpot could benefit from greater AI-driven services, the breadth of their offerings and the size of their markets expose them to some risk of disruption from newer AI-driven software companies.

As such, our current preference is for exposure to vertical software companies — companies that target specific industries, particularly those with mission-critical systems. Customers for this kind of software have often built their entire businesses around the application, making them more amenable to AI-driven improvements over switching software providers entirely. Companies like Tyler Software and Guidewire Software are good examples of mid-cap companies that target government or insurance customers.

Finally, social media and consumer service applications, where Meta and Google have strong customer engagement and large revenue bases, have been significant contributors to the companies’ revenue streams. As these companies continue to improve their core products with increasingly sophisticated AI, revenue growth could substantially increase.

Agentic AI is on its way

Our interactions with AI thus far have been primarily limited to a request-response framework. We ask a question to a chatbot and generally get a detailed and relevant answer in response. But, with limited exceptions, there is no action beyond that. We are left to decide what to do with the information the chatbot provides.

Enabling AI not only with better reasoning capabilities but also with the ability to act on our behalf enters the realm of agentic AI, where AI can act as our agent, completing multi-step tasks on its own, including interacting with other software applications. In our view, widespread agentic AI is likely to be the next major step in AI's evolution and will be a significant driver of AI adoption over the next few years.

A simple example of agentic AI would be an AI agent that could book you a vacation. The AI would have to incorporate your preferences in hotels and airlines, budget for the trip and any other preferences provided. In principle, the AI agent could not only optimize all these variables, but also book the plane ticket, reserve the hotel, populate your calendar with the details, email them to your family and know when to turn on and then off your out-of-office email reply.

Agentic AI is expected to become more common next year and will likely favor established companies with large user bases. But we also expect smaller or newer companies that can create a compelling bundle of agentic services with a compelling user interface and robust privacy standards, to potentially gain market share.

Physical AI: The robots are coming

Physical AI, which includes robotics and other mechanical automation, is a nascent sector we believe is ripe for innovation and capable of both disrupting established services and creating new ones.

The more immediate implementation of automation and robotics is likely to be in autonomous vehicles. Waymo, formally known as the Google Self-Driving Car Project, already has taxis on the road, and we expect Tesla will be next to offer “robo” taxis. A number of small and large companies are working to improve the intelligence behind autonomous systems, including, but not limited to, cars.

For example, progress has been made in robots that can play sports and train by watching videos of games. The ability to both learn tasks with AI and then repeat them with robotics opens a world of possibilities, from factory production to dog walking. While such autonomous services will likely take time to prove themselves efficient and safe, the combination of AI and robotics has the potential to increase productivity substantially.

The problem of over-concentration

Considering the range of services AI could improve and the current expectations that it will succeed in delivering that improvement, investors should ask themselves: What would happen to the stock market if AI failed to deliver?

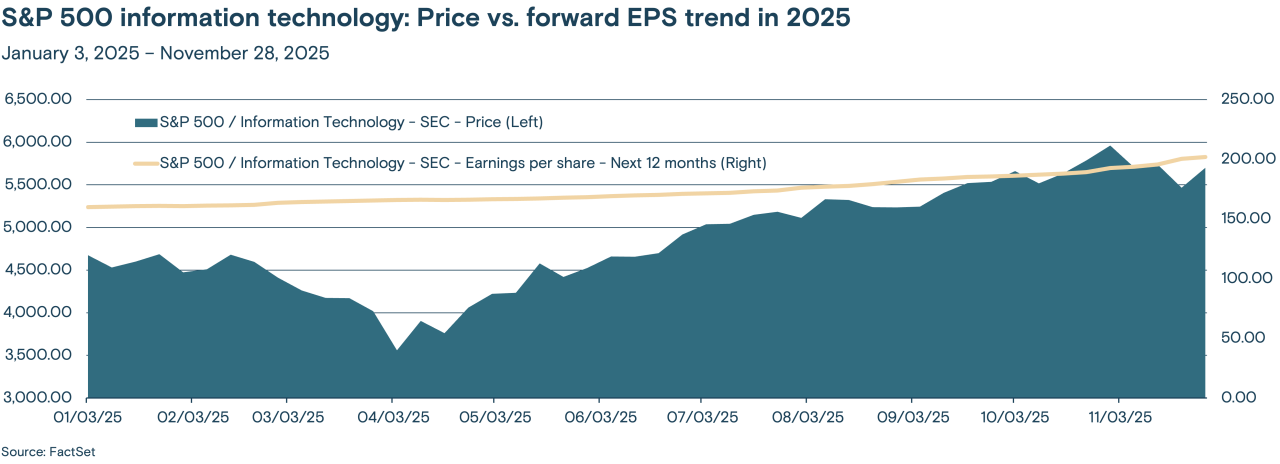

While there has been much discussion about the high valuations of many leading technology companies, the S&P 500® Index’s information technology sector has traded in line with expected earnings, as shown in the figure below, and its current forward price-to-earnings (P/E) ratio is not particularly high. Thus, the key question is whether current earnings expectations will be delivered.