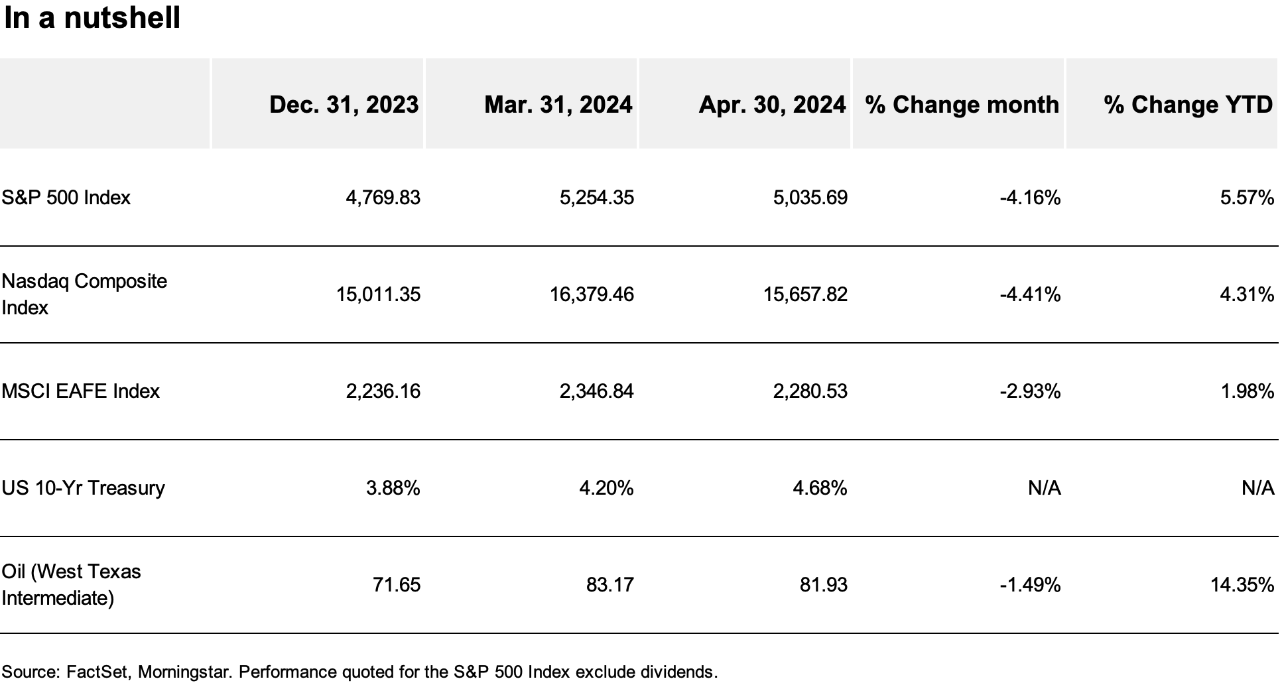

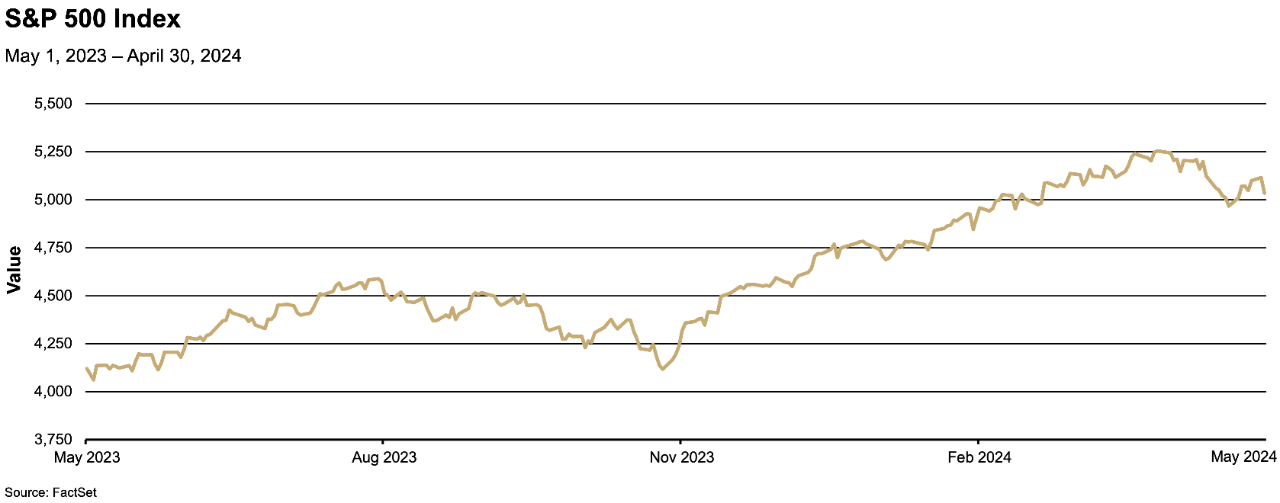

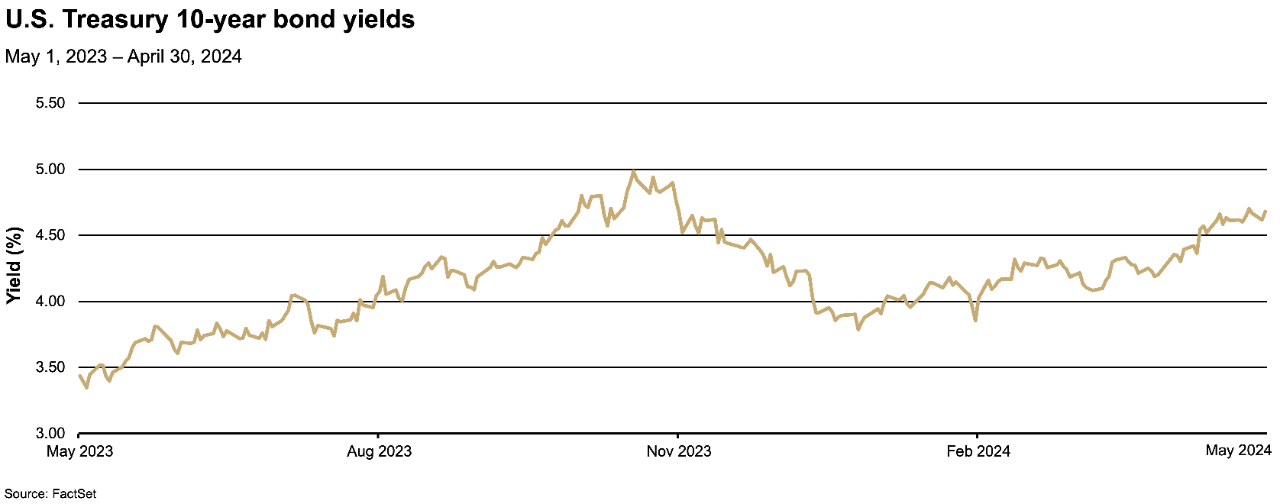

U.S. stock and bond markets got off to a difficult start in April after the March jobs report exceeded even the most optimistic estimates. The surprising jobs report came on the heels of several higher-than-expected inflation reports in recent months, and concern began to build that the U.S. Federal Reserve (Fed) might not be in a position to cut interest rates as fast as what had previously been priced into markets. Minneapolis Fed President Neel Kashkari even voiced the possibility that there could be no interest rate cuts in 2024 if “we continue to see inflation moving sideways.”

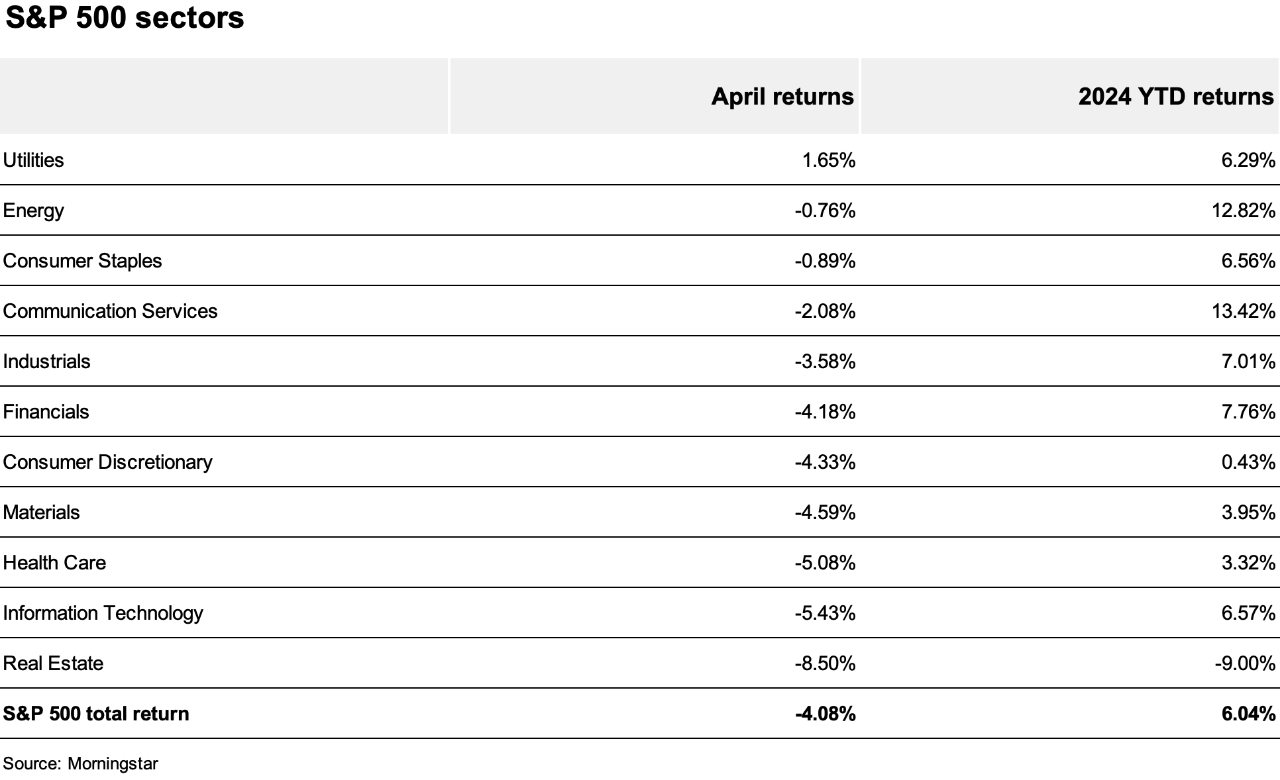

Bond markets responded with sharply higher yields across the Treasury curve. The 2-year yield rose approximately 0.40% in April, while the 10-year U.S. Treasury note climbed 0.48%, leading the Bloomberg U.S. Aggregate Bond Index to end the month down 2.53%, adding to its year-to-date losses. Real estate (down 8.5%) was the worst performing sector in the S&P 500® Index, which is not surprising given real estate’s high sensitivity to interest rates.

Retail sales remained relatively robust in March, providing some optimism about sustained consumer strength. Still, first-quarter gross domestic product (GDP) rose only 1.6%. This figure was well below consensus expectations, giving investors reason to consider the possibility of a worst-case scenario where inflation remains sticky, interest rates stay higher for longer and economic growth continues to slow. The Consumer Price Index (CPI) exceeded consensus expectations for the third consecutive month, leading Fed Chairman Jerome Powell to all but confirm interest rate cuts would be pushed back.

The combined concerns about slower growth and higher rates contributed to a—perhaps overdue—correction in the technology sector. In mid-April, technology stocks saw their largest single-week correction in more than a year. Even Nvidia, a recent shooting star in the technology sector, saw a substantial correction during the month. Keeping in mind that the correction began from an all-time high for the S&P 500 Index, some skepticism about elevated valuations was to be expected.

Some optimism crept back into the market in late April as core Personal Consumption Expenditures (PCE) Price Index inflation—the Fed’s preferred measure—was reported to be broadly in line with expectations, and several of the largest technology companies delivered encouraging earnings reports. Alphabet (Google’s parent company) saw earnings rise 15%, and Microsoft reported better-than-expected earnings. In bonds, yields also regained some lost ground, with 10-year Treasuries ending the month at 4.68%.

Outlook: We have often reiterated our view that turning points in the economy are notoriously difficult to time, and April’s market volatility is a good example of the challenges investors face during these periods. While we are slightly more cautious given the mixed economic signals, we continue to expect that the economy will achieve a soft landing and that inflation will fall. But, as we stated last month, inflation’s decline will not be linear or swift. It is one thing for a central bank to keep inflation from rising, but causing inflation to fall and wringing out its last vestiges is a much more daunting task. With recent data confirming that inflation can remain sticky despite a slowing economy, we maintain our view that the Fed will be conservative, preferring to hold rates as high and as long as it can to ensure inflation doesn’t reignite.

Uncertainty about inflation has accelerated consolidation in equity markets, but we regard the recent correction as healthy and have not changed our view that earnings will remain supportive through the rest of 2024. When interest rates eventually fall, the riskier segments of the market—such as small-cap stocks, companies with relatively lower quality and more value-oriented stocks—should see renewed interest, broadening the strength within equity indices.

Against this backdrop, we think investors should be patient. Over much of the past year, growth stocks and higher-quality companies with strong earnings, good cash flow and strong balance sheets have excelled, and we expect it will take time for sustained outperformance to pivot to riskier segments of the market. Investors will likely need to see a few rate cuts and begin debating when enduring growth will return, which is a considerably higher burden of proof than believing a soft landing is likely.

We continue to see value in bonds despite the recent volatility. Once the Fed lowers its monetary policy rates, we expect bond yields to fall across the curve. While we and the market maintain some concern about supply putting upward pressure on longer-dated Treasury bonds, the Treasury department recently confirmed that it does not expect to increase bond issuance over the coming quarters. Thus, the rise in longer-dated bond yields could offer a compelling opportunity to lock in significant yields for the length of the bond.

Like in equities, we encourage investors to be patient as they await lower bond yields. While we believe inflation will eventually fall and rates will follow, the path toward the Fed’s 2% long-term average target rate will be bumpy and prone to setbacks. Indeed, the largest risk to financial markets remains inflation persisting above the Fed’s target level, supported by a stronger-than-expected economy. While such a scenario will fuel short-term market volatility, we continue to believe the long-term macroeconomic environment remains broadly supportive for stocks and bonds and thus encourage investors to retain their positions—and their patience.