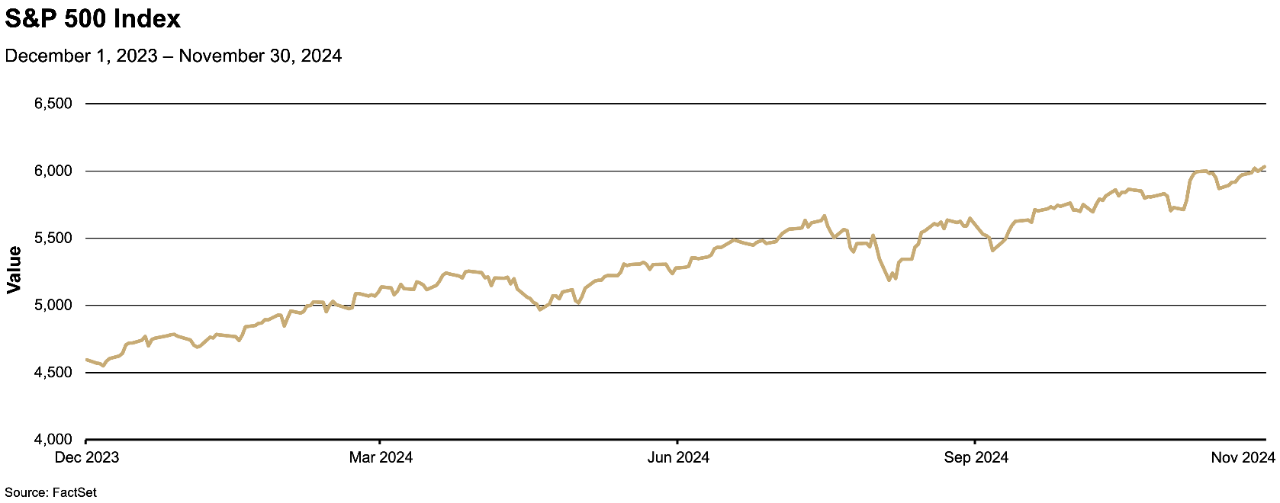

The markets broadly judged the results of the U.S. presidential and congressional elections as positive for economic growth, but also potentially inflationary. The S&P 500® Index surged after the election and, despite a mid-month correction, ended the month at yet another all-time high. While it took longer to determine that the Republican Party would retain control of the House of Representatives (albeit by a small margin), and thus both houses of Congress, consensus grew that the incoming administration was likely to extend the existing tax cuts, possibly lower taxes and generally implement a more business-friendly approach to regulation.

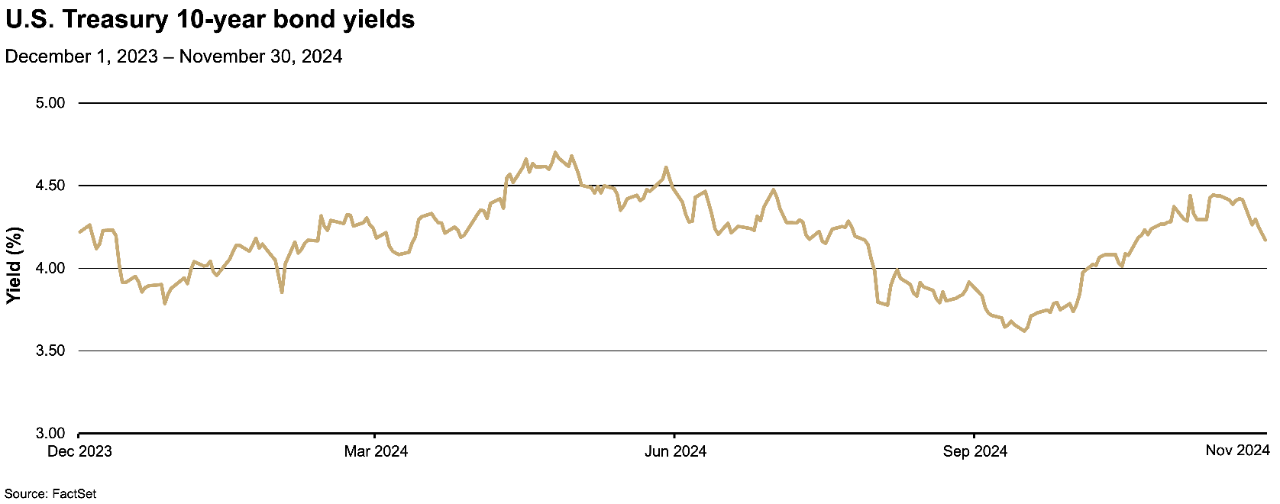

The reaction in the bond markets was more mixed. Longer-dated Treasury yields had been rising since September, partly due to uncertainty around the election. 10-year Treasury yields rose further in the days after election but peaked near 4.45%. The nomination of Scott Bessent—a known deficit hawk—for Treasury Secretary kicked off a rally, and a combination of high absolute yields attracting buyers, inflation data meeting forecasts and expectations for interest rate cuts all worked to sustain the rally into month end.

The economic data released over the month was mixed, but broadly supportive for sustained economic growth. With the exception of the strike and hurricane distorted October figures, monthly job creation has rebounded from the summer lows. Retail sales were again robust, third-quarter gross domestic product (GDP) was revised higher to 2.8% (above expectations), the Purchasing Managers’ Index (PMI) rose more than expected and the Institute for Supply Management (ISM) survey showed continued expansion.

Meanwhile, inflation data reported over the month, while meeting market expectations, indicated the trend toward the U.S. Federal Reserve’s (Fed’s) target rate may be stalling, with both the Consumer Price Index (CPI) and the Personal Consumption Expenditures (PCE) Price Index rising modestly year over year. While the incoming administration campaigned on a number of potentially inflationary policies (notably more tariffs and less immigration) equity markets by and large adopted a wait-and-see approach.

However, expectations for interest rate cuts were significantly scaled back over the month. While the Fed did cut its target rate by 0.25% at its November meeting, by November end expectations for future cuts had been significantly reduced to between three and four more cuts through the end of 2025.

Outlook: We expect economic growth will remain robust and the incoming administration will enact pro-growth policies. However, there remains a high level of uncertainty around which—and how much—of the advertised policies will become law.

The largest risk to our base case view that the U.S. economy will achieve a soft landing is expansionary fiscal policies or sticky inflation forcing the Fed to slow the pace of rate cuts even more than the market currently expects. While the consumer sector has demonstrated its resiliency, there are signs of weakness, and persistent inflation or sustained higher interest rates could eventually take a larger toll on consumer confidence.

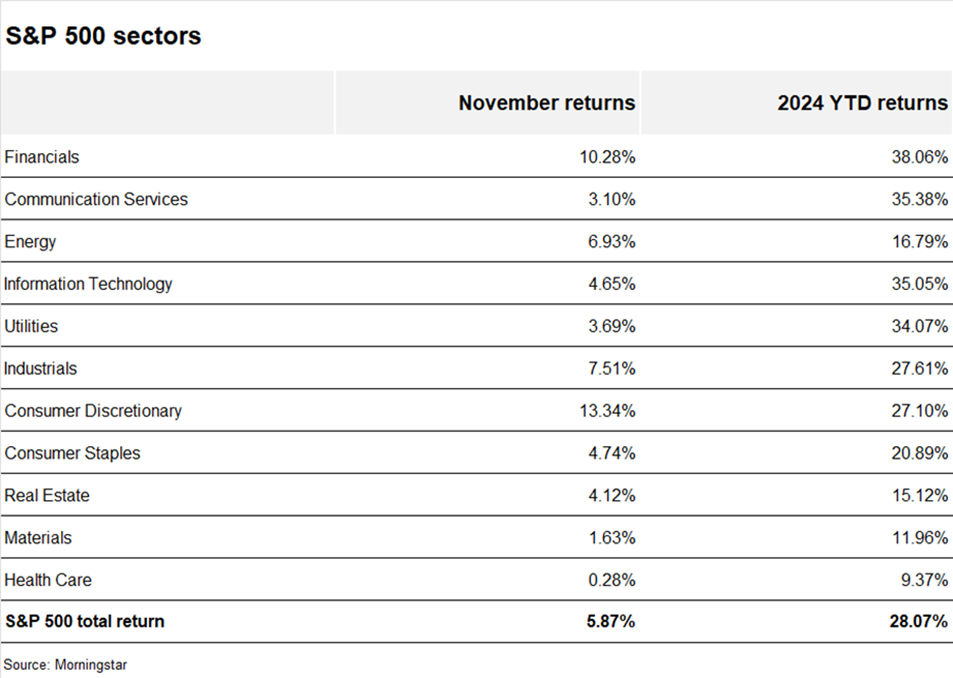

We maintain a modest overweight to equities versus fixed income going into year end. In our view, equity markets need sustained economic growth to both extend the recent strength in the more cyclical sectors and to see broader gains in value stocks as well as the mid- and small-capitalization segments of the market. While we remain optimistic, volatile economic data comes hand-in-hand with turning points in the economy. Furthermore, we believe it is too soon to make aggressive assumptions about the incoming administration’s economic policies and the effects on the economy, inflation and interest rates.

However, we believe the market’s current expectations for the Fed’s interest rate cuts over the coming year are reasonable, if a bit conservative. As such, we expect Treasury yields will likely remain in a range around current levels, though may be volatile within that range. We believe such an outcome justifies a more neutral strategic stance, focused in shorter-term maturities, and careful monitoring of both economic data and the incoming administration’s policy choices.

Drilling down

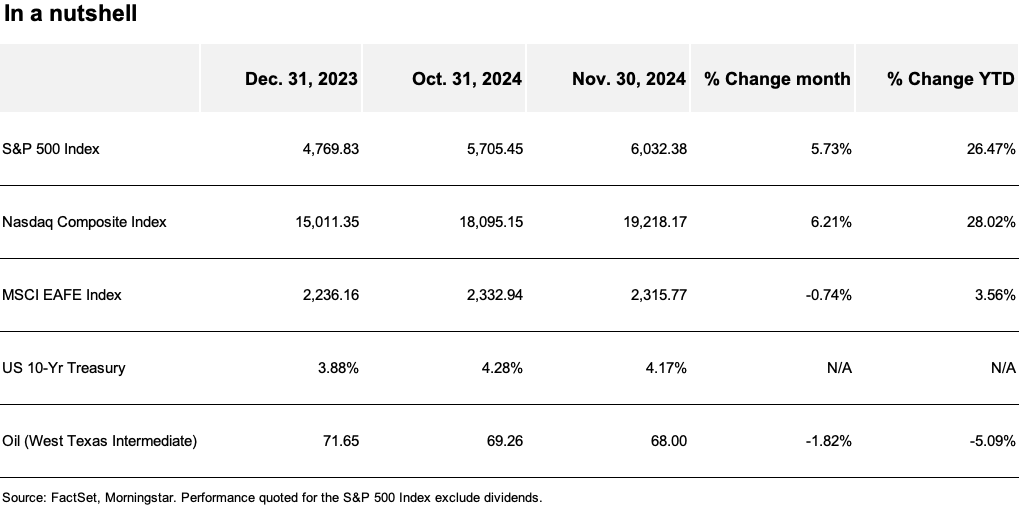

U.S. stocks rise

The S&P 500 Index rose 5.73% in November, from 5,705.45 at the October close to 6,032.38 at the end of November. The total return of the S&P 500 Index (including dividends) for the month was 5.87%, bringing its year-to-date return to 28.07%.

The NASDAQ Composite Index® also rose in November, up 6.21% from 18,095.15 at the end of October to 19,218.17 at the November close. Year to date, the index has risen 28.02%.

![ROI on AI? [PODCAST]](/content/dam/thrivent/fp/fp-insights/advisors-market360-podcast/advisors-market360-podcast-16x9-branding-insights-card.jpg/_jcr_content/renditions/cq5dam.web.1280.1280.jpeg)