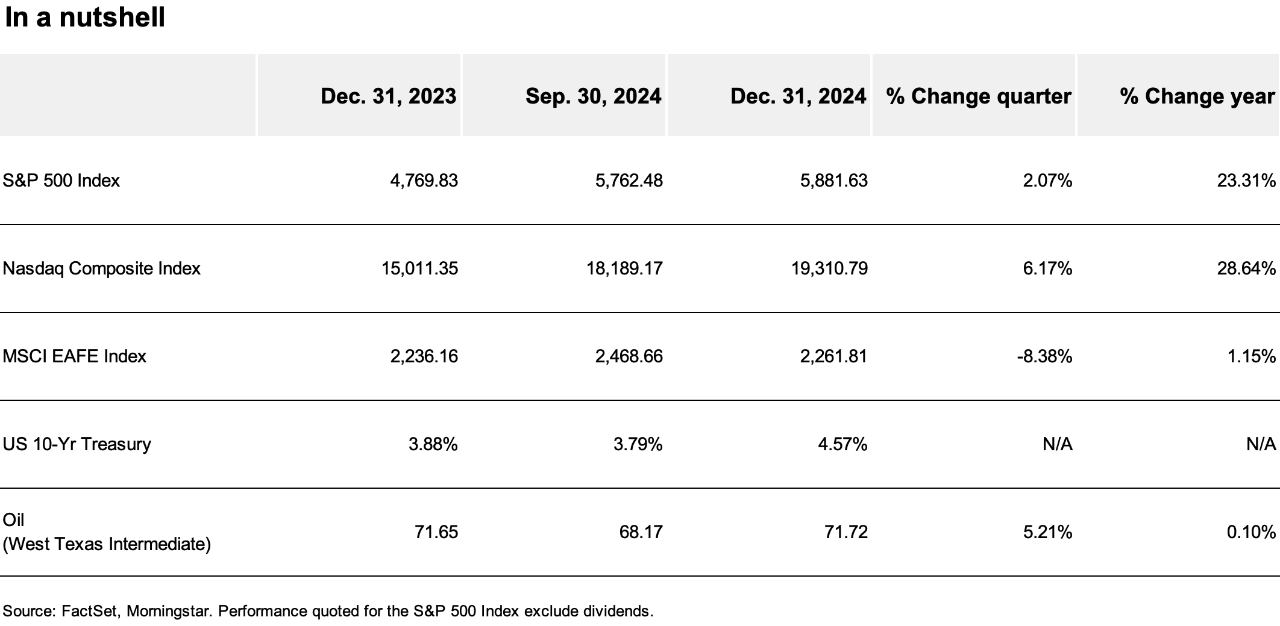

2024 was a year of transition. The economy looks to have achieved a soft landing, monetary policy became supportive, a new U.S. president was elected, the Middle East became a growing source of geopolitical concern and artificial intelligence (AI) burst onto the investment scene. By and large, markets embraced these changes, with the S&P 500® Index setting 57 new record highs.

Despite consensus expectations in late 2023 that a recession was likely, the U.S. economy proved resilient, with gross domestic product (GDP) expected to rise 2.7% in 2024 and the economy poised for continued growth this year. Absent an abrupt turnaround, the U.S. Federal Reserve (Fed) thus achieved the much-coveted soft landing.

2024 also saw a significant and rapid transition in technological innovation and application. By the summer of 2024, 40% of Americans had used generative AI, and almost 10% used it every workday.1 Unsurprisingly, Nvidia Corp.—which makes the most sought-after computer chips for processing AI—made $91.2 billion in revenue in the first nine months of the year.2 In summary, 2024 was a year that many businesses, investors and consumers started to accept that AI would be a part of life and a likely significant source of profit.

Despite robust economic growth and surging investment in AI, the U.S. inflation rate declined, allowing the Fed to transition from a stable interest rate policy (its last rate increase was in July of 2023) to an accommodating one. On August 20, Fed Chairman Jerome Powell stated, “The time has come for policy to adjust” and in September the long-awaited, rate-cutting phase of the cycle began.

Last year also was a year of political transition. Donald Trump’s election, along with the Republican party gaining control of the Senate while maintaining control of the House of Representatives, ushered in a wave of expected policy changes. While economic policy is generally expected to be business-friendly, there is significant fiscal and foreign policy uncertainty. Outside the U.S., geopolitics and conflict remained a constant source of uncertainty, notably with the war in the Middle East expanding from Gaza to Lebanon, skirmishes between Israel and Iran and the collapse of the Syrian government.

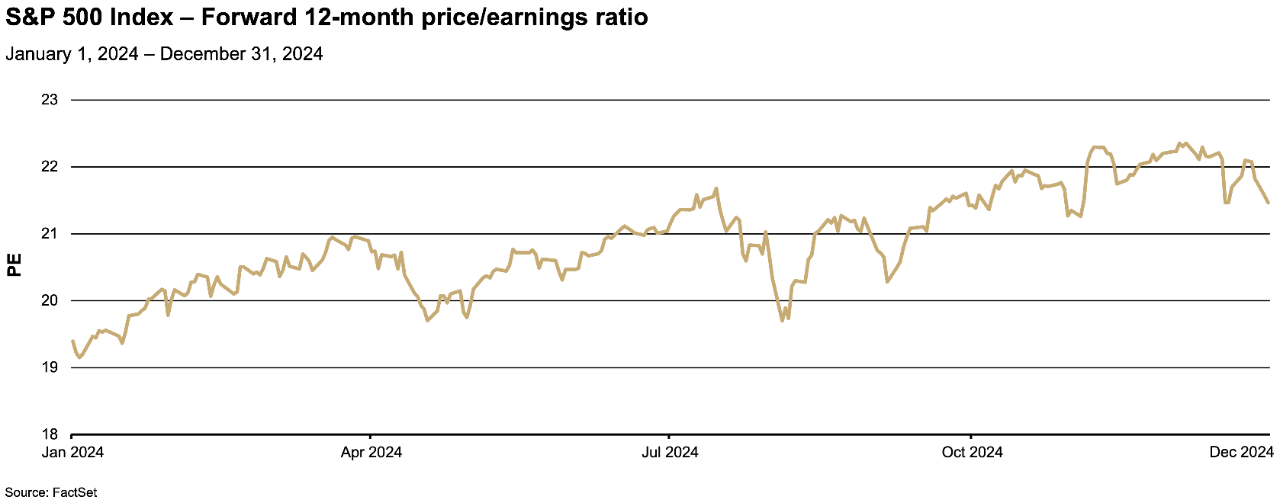

Throughout all these transitions, the U.S. stock market remained generally bullish. On January 19, 2024, the S&P 500 Index set its first new high in two years and then did it again 56 times3 in the remainder of 2024. Despite—and in some cases because of—all the transitions, the U.S. economy continued to look like the most resilient and promising developed economy in the world.

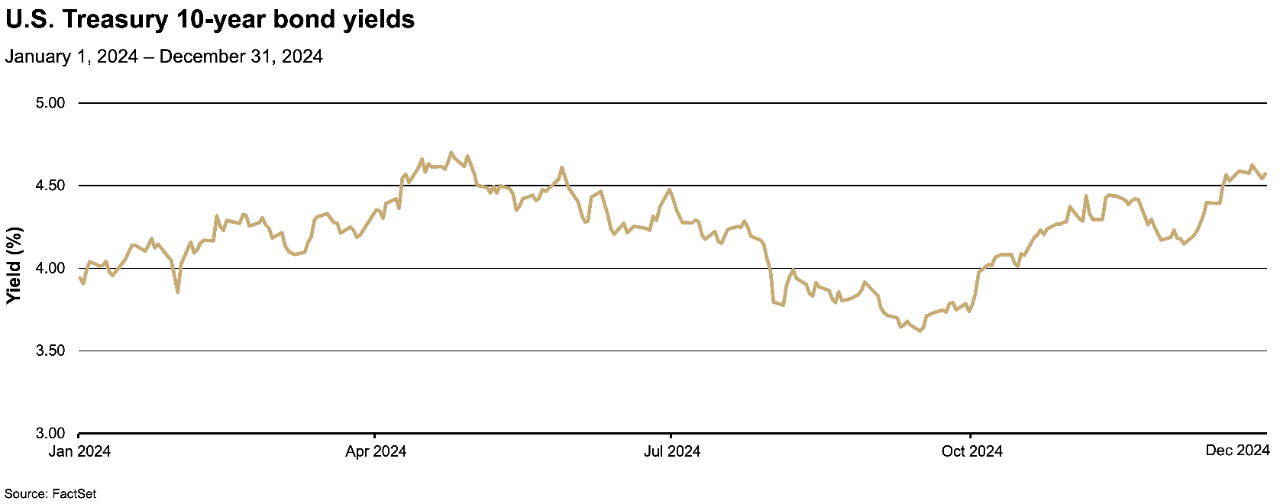

Treasury bonds were more volatile in 2024, with yields rising and falling with the ebbs and flows of growth and inflation expectations. Benchmark 10-year yields ended the year at 4.57%, 0.69% higher than at the start of the year. Corporate bonds were relatively more stable, benefiting from strong corporate fundamentals and from expectations that interest rates would remain higher for longer, thus sustaining strong demand from investors seeking their relatively attractive absolute yields. As an asset class, bonds (as measured by the Bloomberg U.S. Aggregate Bond Index, which tracks the performance of U.S. investment-grade bonds), delivered a modest return of 1.25% in 2024.

While there are many potential headwinds, we expect 2025 will confirm that the economy had a soft landing in 2024 and should see sustained and possibly accelerating growth in the year ahead. As such, we believe stocks can rally further in 2025, driven in part by continued gains in productivity (such as from AI) helping to fuel earnings growth as well as the new administration’s regulatory and tax policies. Risks remain, however, including higher interest rates roiling equity and bond markets, and a softening labor market.

The bond market faces more challenges in 2025, and thus we believe Treasuries will likely see another year of volatility. Whether it is concern about growth being too strong, fiscal policy being too loose, inflation being too sticky or just an abundance of supply, we believe bonds will remain more attractive for their yield and diversification benefits rather than for their potential to generate high total returns.

Drilling down

U.S. stocks set 57 new highs

The S&P 500 Index rose 23.31% in 2024, marking its best-performing, two-year period since 1998. Stocks were supported by resilient economic growth, encouraging earnings and expectations that both inflation and interest rates had likely peaked. The total return of the S&P 500 Index (including dividends) was 25.02% over the period.

The NASDAQ Composite Index® was up 28.64% in 2024, supported by strong performance in technology and technology-related companies over the year, fueled partly by expectations that advances in AI would boost growth.

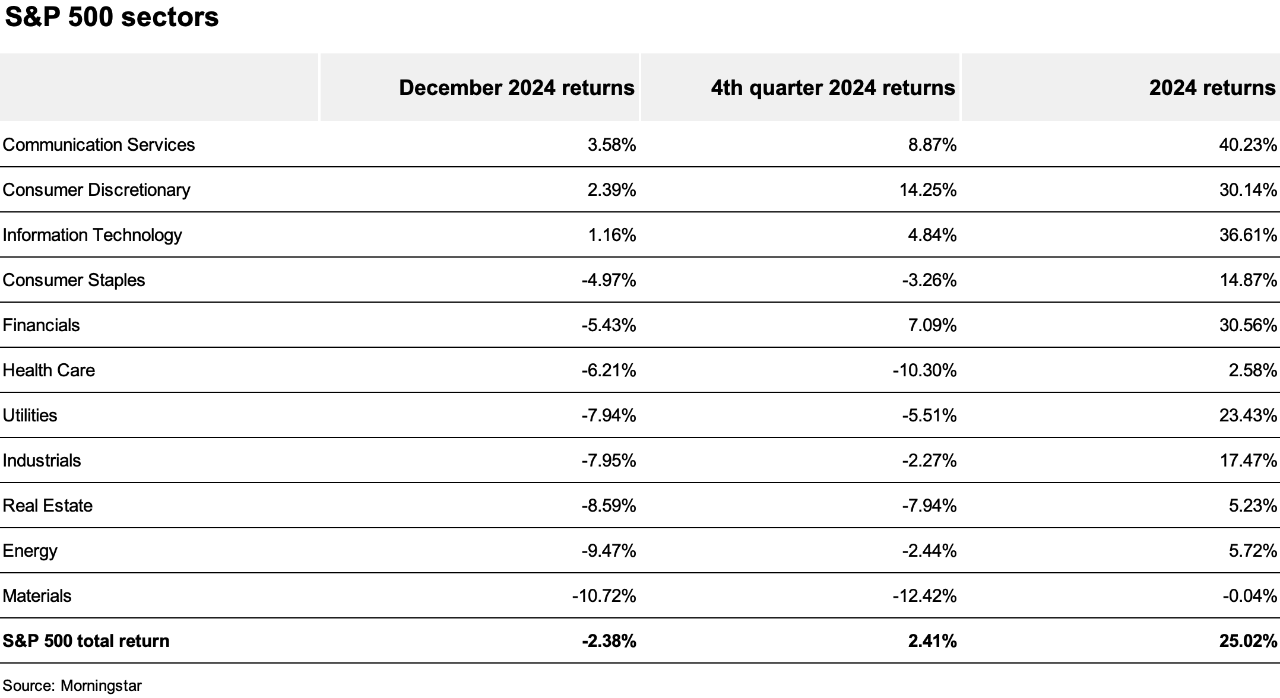

Most sectors rose in 2024

Of the S&P 500 Index’s 11 sectors, all but the materials sector generated positive returns in 2024. Communication services and information technology led the way, up an impressive 40.23% and 36.61%, respectively, over the year. While strength among the various sectors broadened in the latter half of 2024, December’s correction in the S&P 500 Index (-2.38%) weighed heavily on the more cyclical sectors, such as materials (-10.72%), industrials (-7.95%) and utilities (-7.94%).

The chart below shows the results of the 11 sectors for the past month, fourth quarter and calendar year 2024.

![2026 Market Outlook [PODCAST]](/content/dam/thrivent/fp/fp-insights/advisors-market360-podcast/advisors-market360-podcast-16x9-branding-insights-card.jpg/_jcr_content/renditions/cq5dam.web.1280.1280.jpeg)