For example, small-caps initially trailing in the early months of the pandemic, surged by the third quarter 2020 into the first quarter 2021, as vaccine rollouts, combined with strong monetary and fiscal support, fueled a risk-on rally. This led to a significant outperformance of small-caps relative to large-caps of more than 32% over the period 9/30/2020 – 2/26/2021.

It’s also important to consider that what is true for small-caps on average is far from universally applicable. The small-cap universe is vast and diverse, encompassing companies across industries, geographies and various stages of development. Although broad-based analyses may paint a mixed picture for small-cap stocks, skilled active managers have the ability to uncover companies with strong fundamentals and resilient business models poised in any market environment.

While the price-to-earnings (P/E) ratio of the small-cap Russell 2000® Index has lagged in recent years, historical data highlights extended periods of relative strength.

Capturing early-stage growth

Beyond their important role as a diversifier, small-cap stocks can offer highly efficient access to emerging long-term growth drivers. Unlike their large-cap counterparts, which more often move in step with broader market sentiment, small-cap companies are often highly specialized, focusing on niche markets and developing cutting-edge solutions that cater to evolving consumer and business demands. These attributes make small-caps particularly effective at capturing early-stage growth opportunities tied to broad economic trends.

A common misconception about small-cap investing is the belief that the most promising small companies tied to such trends are increasingly likely to remain private, limiting opportunities for public market investors. While it is true that the number of initial public offerings (IPOs) have declined over recent decades, and some high-profile startups have opted to remain private, recent trends suggest this narrative is shifting. Many so-called unicorn startups that once attracted sky-high valuations are now facing financial strain, with more limited access to capital and diminishing growth prospects1. This environment reinforces the value of actively managed small-cap strategies.

Key long-term trends

Skilled active management in small-cap U.S. equities can provide targeted exposure to three powerful long-term trends shaping financial markets.

- Artificial intelligence (AI) boom: AI is transforming industries by enhancing efficiency, predictive analytics and innovation. Many small-cap companies are integral to this ecosystem, supporting AI infrastructure, developing specialized software and supplying critical hardware.

- Aging demographics: With the U.S. population aged 85+ expected to double by 20312, demand for health care services, assisted living and medical innovations is growing. Small-cap companies are at the forefront, providing solutions that address this demographic shift.

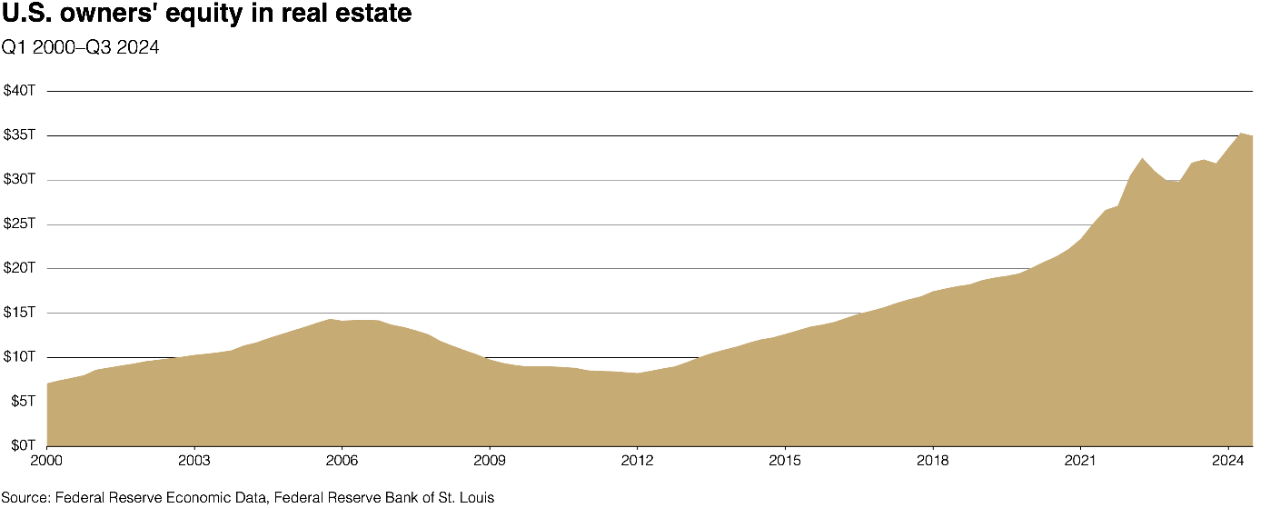

- U.S. housing shortage: Rising home values and limited housing supply are driving increased spending on renovations and remodeling. Small-cap firms in the repair and remodeling (R&R) sector are well-positioned to benefit from this trend.

These themes are reflected across several of Thrivent’s investment strategies, including Thrivent Aggressive Allocation Fund, Thrivent Moderately Aggressive Allocation Fund, Thrivent Dynamic Allocation Fund, Thrivent Conservative Allocation Fund and Thrivent Small Cap Growth Fund.

The boom in AI

The rapid advancement of AI is reshaping industries, creating new markets and transforming global economic structures. Estimates suggest AI could contribute as much as $15.7 trillion to the global economy by 2030, with gains driven by increased productivity, automation and innovation3. From health care and finance to manufacturing and logistics, AI is dramatically redefining how businesses across all sectors operate and interact with customers.

A significant set of small-cap companies play a vital but underappreciated role in the AI ecosystem. These firms, which possess specialized technologies that address the specific infrastructure, hardware and software needs of AI applications, often excel in niche areas where large-cap companies are unable to compete as effectively. In the AI sector, this includes specialized segments within advanced manufacturing technologies, semiconductor components, data services and software solutions.

The accelerated pace of AI development has also boosted demand for faster data transfer and advanced computing hardware. Networking bandwidth, for example, is a critical limiting factor for AI data centers, which rely on high-speed data transfers to support machine learning and deep learning applications.

Case study: Fabrinet (FN)

Fabrinet, a leading provider of advanced optical and electronic manufacturing services, exemplifies how small-cap companies can capitalize on AI-driven growth. On behalf of its customers, the company fabricates specialized optical components that play a crucial role in enhancing the performance of AI clusters—networks of high-powered servers designed to process vast amounts of data for machine learning and large language model training. These clusters are particularly reliant on high-speed, efficient data transfer, making Fabrinet’s technology essential in datacenters. Growing demand for higher optical speeds is expected to accelerate Fabrinet’s revenue, with our projections indicating growth more than twice the consensus estimates.

A significant driver of this growth is the company’s partnership with NVIDIA Corporation, where Fabrinet manufactures critical networking components for AI infrastructure. Because AI datacenters require exceptional bandwidth capacity, Fabrinet’s role in supporting next-generation networking solutions has become increasingly vital.

Fabrinet is also seeing growth in its telecommunications segment, which we expect to expand by more than 10% in the long term. Within this business, the datacenter interconnect (DCI) market accounts for more than 20% of revenue and is driven by the growing need for faster data transfers between AI datacenters. Major vendors such as Cisco, Ciena and Infinera all rely on Fabrinet for their optical manufacturing needs, illustrating the company's dominant competitive position in this space.

The company’s automotive segment presents additional growth opportunities. Here Fabrinet’s services support Tesla’s rapidly expanding supercharging network, the growth of which has been further bolstered by other major automakers adopting Tesla’s charging port technology. Moreover, Fabrinet is a key supplier of LiDAR manufacturing, which uses light in the form of a pulsed laser to measure ranges, serving all major LiDAR providers, positioning the company at the forefront of innovations in autonomous driving. Supported by these tailwinds, Fabrinet’s automotive revenues have expanded by more than 60% over the past two years.

Capitalizing on a transformative population shift

The most significant global demographic trend is the rapid aging of the population. This aging trend presents both societal challenges and significant opportunities for companies positioned to meet the growing demand for health care, end-of-life care and senior living solutions. The growing need for all things health care encompasses a range of sectors, from long-term care and specialized medical treatments to innovative therapeutics and advanced medical devices.

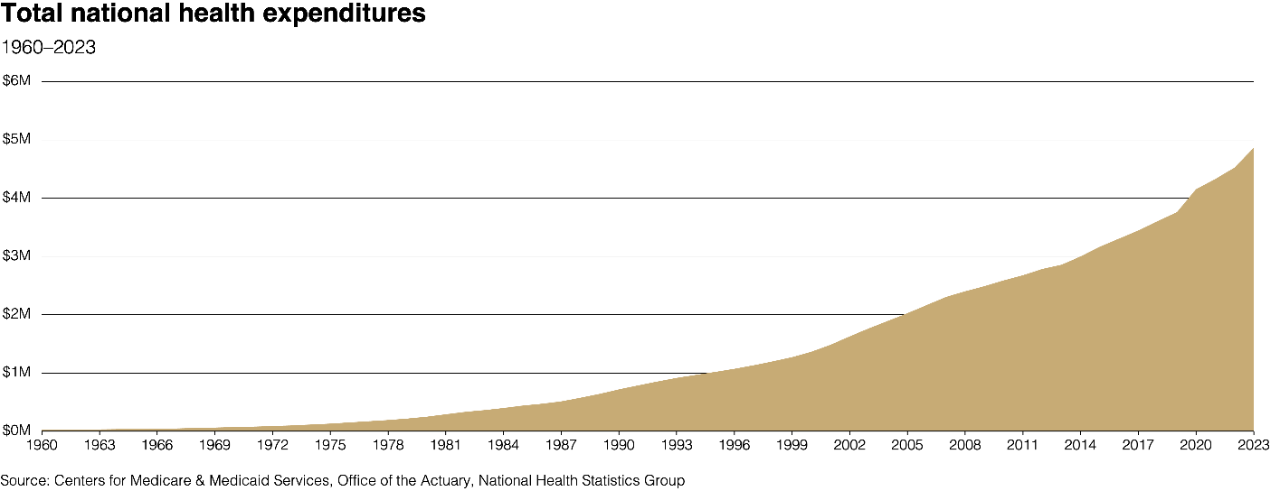

According to projections by the Centers for Medicare & Medicaid Services, U.S. national health expenditures are expected to reach $7.7 trillion by 2032, up from $4.8 trillion in 20234. This represents an increase of approximately 60% over the nine-year period. We believe many of today’s small-cap companies will play a pivotal role in meeting this demand and potentially evolve into the large-caps of tomorrow.

In the U.S., the convergence of an aging, affluent population with the rapid expansion of innovation-driven industries is generating strong momentum for health care-related demand. This surge is, in turn, driving growth in property sectors that directly support health care advancements and cater to the unique needs of older adults—such as life sciences facilities, medical centers and senior housing developments.

![Investing in municipal bonds [PODCAST]](/content/dam/thrivent/fp/fp-insights/advisors-market360-podcast/advisors-market360-podcast-16x9-branding-insights-card.jpg/_jcr_content/renditions/cq5dam.web.1280.1280.jpeg)