High-level management

The broad and experienced team of Thrivent investment professionals oversees the managed accounts investment process. Key features of the program include:

Long-term oriented. The investment team initially sets up the long-term strategic allocations of each portfolio and monitors these accounts daily in terms of risk management, manager performance and potential tactical changes.

Active management. The team actively trades the model portfolios—shifting tactical allocations when deemed necessary—and will replace funds when performance has deteriorated, when their investment style has shifted or when a significant change in management or process casts doubt on the fund’s ability to produce similar results in the future.

Style purity. The management team uses a sophisticated selection process intended to identify style-pure managers and funds with consistent risk-adjusted performance that it believes are most likely to outperform over a full market cycle. Then the team monitors managers and funds on an ongoing basis to make sure they maintain this style consistently. This discipline helps to ensure that the model portfolios consistently provide market exposures that align with the team’s overall market views and objectives.

Diversification of styles and managers. The Thrivent Managed Accounts program provides a broad array of investment styles and managers. The Model Portfolios team uses a hybrid approach in terms of management styles, blending both actively managed and passive funds. The actively managed products may use either a fundamental, bottom-up security selection process or an active quantitative-based management approach. Additionally, the team recognizes that sometimes passive exchange-traded funds (ETFs) may be the best way to maintain tactical exposures or hedge active exposures to specific asset classes while keeping expenses down. Thrivent model portfolios also use a diverse blend of proprietary and non-proprietary funds, while many competitors offer model portfolios that use mostly or only proprietary funds.

As-needed trading. While many firms have a set schedule to conduct trades in model portfolios on a quarterly or monthly basis, Thrivent Model Portfolios team has a more fluid and responsive process. These professionals constantly monitor the portfolios using both quantitative and qualitative tools, relying on the latest market and economic data to form views and make decisions. They implement tactical trades in the model portfolios as needed rather than according to a pre-set schedule. The team will also trigger rebalancing as needed to keep the model portfolios in line with target allocations.

Flexible income distribution options. Clients in Thrivent Income-Focused Managed PortfoliosTM have the option to reinvest dividends or to request a set amount of income on a monthly, quarterly or yearly basis. They can choose to automatically distribute all the dividends from the underlying mutual funds in either income-focused model. Although this means the clients’ income amounts will fluctuate, it is the most efficient distribution method because clients are not selling positions to pay income, which could necessitate some unintended rebalancing.

Continual oversight. Thrivent model portfolios are developed by a dedicated portfolio manager and research analyst who work hand-in-hand with Thrivent’s Mixed Assets & Market Strategy team for strategic and tactical allocations. In addition, guidance comes from the Thrivent Asset Management Investment Strategy committee, which includes Thrivent Asset Management’s most senior executives. Portfolios are monitored continuously for their overall performance, the underlying funds’ performance, manager changes and style purity.

Why Thrivent model portfolios?

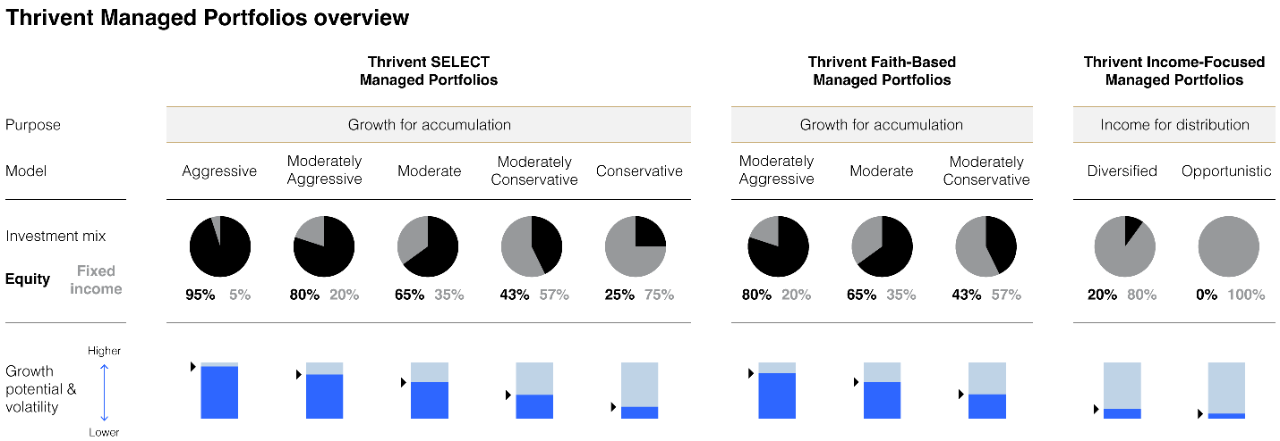

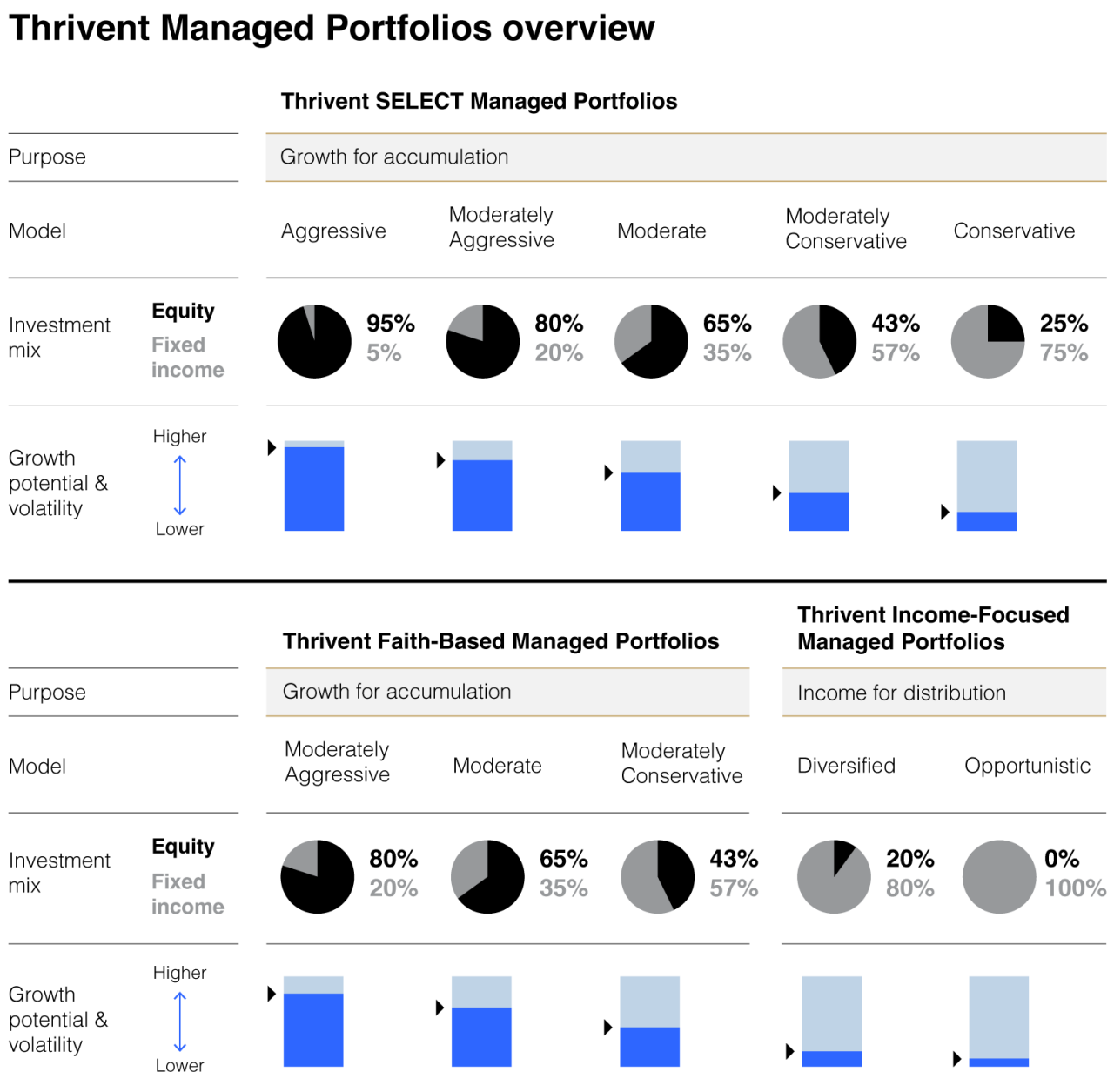

Thrivent Asset Management launched its first mutual fund in 1970 and its asset allocation funds in 2005. The Thrivent SELECT Managed PortfoliosTM, created in 2007, have a long track record of performance, and the Thrivent Income-Focused Managed Portfolios have been around since 2012. The Thrivent Faith-Based Managed Portfolios were launched in 2020.

The Thrivent Managed Accounts program is supported by the full power of a Fortune 500 company with more than $179 billion in assets under management.2 The investment team is comprised of more than 140 seasoned investment professionals, of which more than 80% have a graduate degree, a CFA® designation, or both. More than 80% of Thrivent investment professionals also have at least 10 years of investment industry experience and more than 50% have at least 20 years.

To learn more about the Thrivent Managed Accounts program, contact a regional consultant or call 800-521-5308.

![Short-term bond investing [PODCAST]](/content/dam/thrivent/fp/fp-insights/advisors-market360-podcast/compass-insights-card-v1.jpg/_jcr_content/renditions/cq5dam.web.1280.1280.jpeg)

![Q&A with the managers: Thrivent Limited Maturity Bond Fund [VIDEO]](/content/dam/thrivent/fp/fp-insights/fund-commentary/q-a-with-the-managers-thrivent-limited-maturity-bond-fund/qa-with-the-managers-thrivent-limited-maturity-bond-fund-video.jpg/_jcr_content/renditions/cq5dam.web.1280.1280.jpeg)